- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

It depends. Let's take each question separately.

- If you work for an employer whose office in New York (NY), but you physically work in DC, where you live, then all income is taxed to DC. On the other hand if you physically go to New York to work, then you would file a NY State return as a nonresident and pay tax on only the income earned while working in NY.

- If you file as a nonresident, then only your W-2 would have NY in the state boxes which would carry to the NY return.

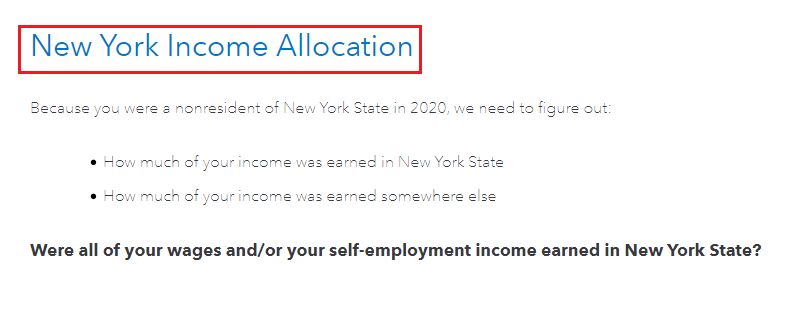

- By entering the correct state information on your husband's W-2, and by selecting Nonresident on the NY return, then TurboTax will automatically omit the taxing of his income.

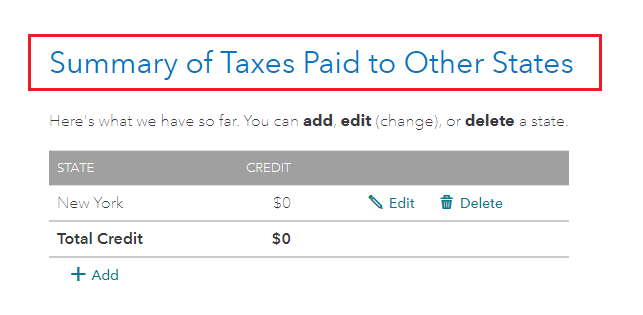

- During the interview both at the beginning where it asks if you had income from another state, and in the DC portion, it will allow you to enter a credit for taxes paid to another state.

- View the images below for nonresidency and credit for taxes paid to another state

- Unless your state has special rules you should be able to file jointly on both returns. Click here for specific details by selecting each state.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

January 24, 2021

8:39 AM

181 Views