Anonymous

Not applicable

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

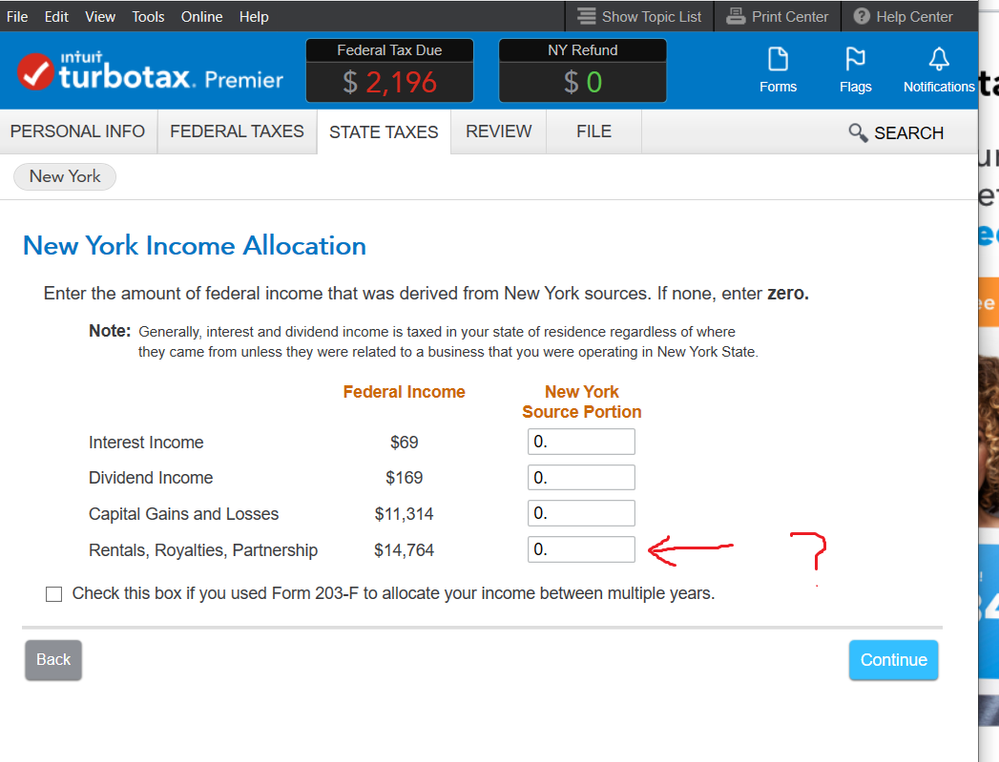

I have an out of state rental property operating at a loss. How do I reflect this on State return?

I live in TX but have a rental in NY operating at a loss at around -$4000.

All of my rental income is in NY so would I enter $14764 even if I'm operating at a loss?

I have some S-corp distributions as well but that is all in TX and not part of NY, how do I separate the two on this line?

Would I need to fill out the Nonresident business allocation schedule? Not sure if rental is considered "business".

June 29, 2020

9:34 PM