- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

TurboTax MO-5674 PTC - property tax credit instructions for Missouri state, eligible taxpayer:

Follow the TurboTax interview series of questions for the property tax credit. Enter all of your income in your “My Info” section. This includes your Social Security Number, Birth Date and, if retired due to disability, enter “retired 100% disability” or whatever your actual federal status is according to your tax forms.

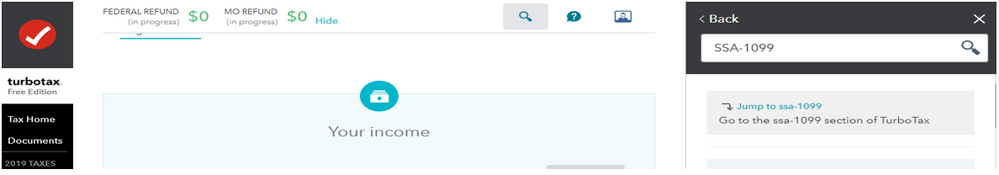

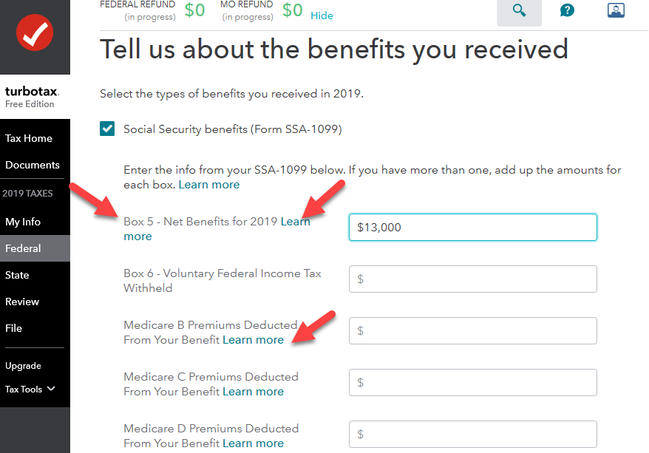

In the Federal section, if your only income is an SSA-1099, you should continue with the interview series of question until you reach the question, “Yes, let’s work on social security benefits, or you can go to the search box and type in “SSA-1099” and then click on the “jump to” link to enter the income that you received. Make sure all of the boxes entered in your document match what is entered into your TurboTax software (numbers and boxes checked)!

Total Net Benefits (Box 5, below) is Box 3 less Box 4 on your SSA-1099 form.

When you see “Learn More” in TurboTax, click on the letters for further details!

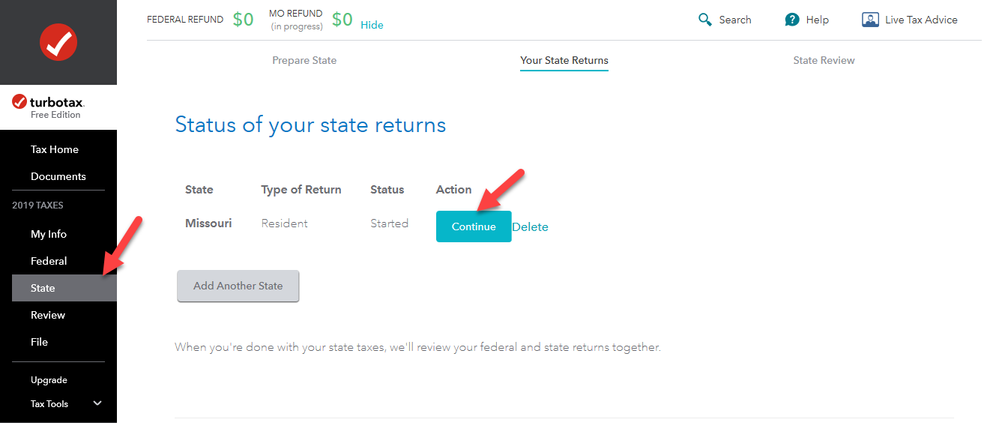

Continue to answer the TurboTax interview series of questions, until you “Wrap Up Income” and complete your Federal Return. Once you complete the TurboTax interview series of questions (you entered your Missouri address in the “My Info” section, before Federal and State) where you lived for the full year, you will be automatically led to your state return.

Your 2019 Missouri Return > Did you file a Missouri State Return?

Yes – verify your address before property tax credit screen – Answer “Yes” if you are eligible

No – this is the next screen – Answer “Yes” if you are eligible – see screen queries, below:

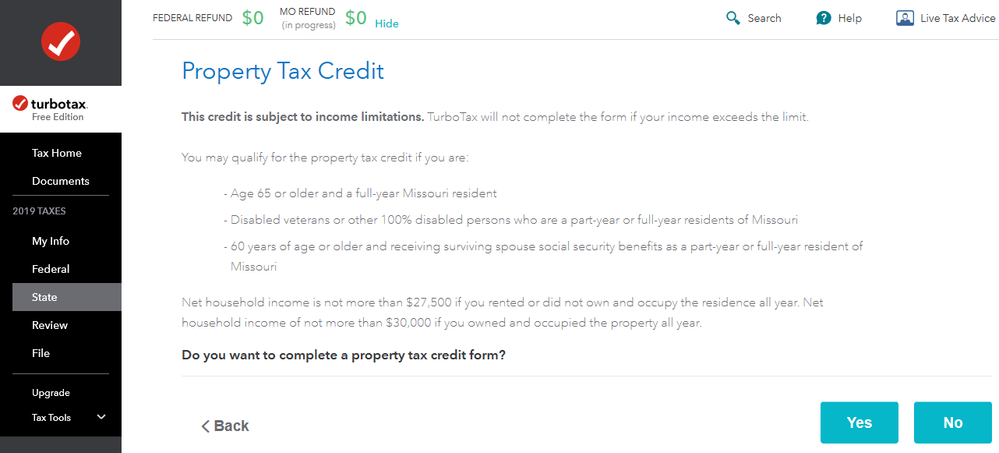

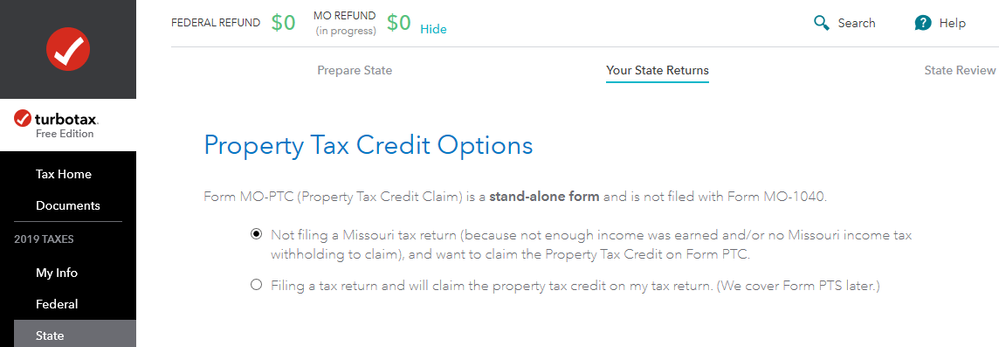

Continue to Property Tax Credit Options, screen, and select whether you are filing a state tax return or just claiming the property tax credit.

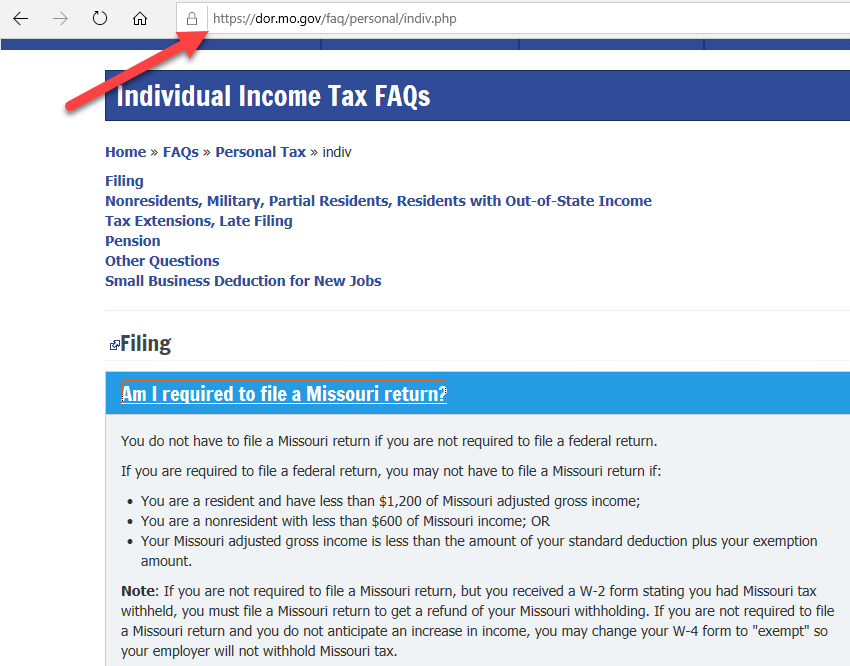

See below, for the MO state browser to identify whether you are required to file a state return in order to obtain the credit. Here is an excerpt, of the Missouri state frequently asked questions.

Continue to answer the questions, based on your circumstance, on each of the following TurboTax screens, and based on your eligibility, TurboTax will generate the relevant forms for you to file /e-file:

- Property Tax Credit

- Additional Information Needed

- Household Income

- Rental Certification Summary

- Rental Address

- Type of Rental Property

- Rental Information (this should match your Form 5674, signed by your landlord)

- Landlord Information (this should match your Form 5674, signed by your landlord)

- Related to Landlord

- Another Rental

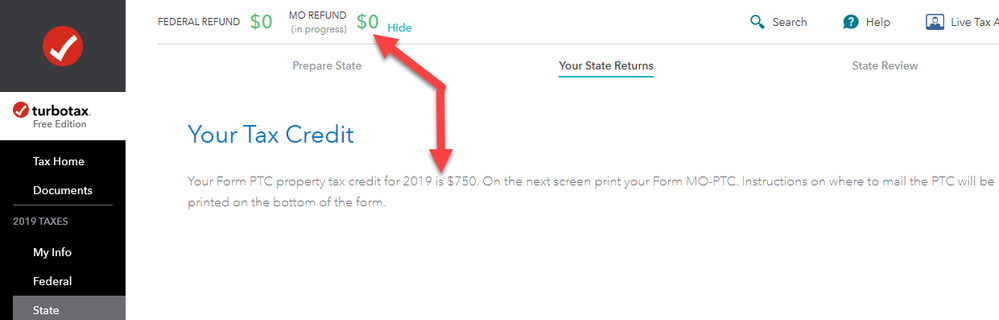

If you elected not to file a Missouri state return, your credit will not show up in the MO REFUND at the top of the page, as you are not filing a state return. You will print and mail the PTC form.

If you elected to file a Missouri state return, you will go through a few more screens before you get to the screens, below:

- Do you have any of these items, Taxed by Missouri (i.e. NOL, K-1, business deductions, other MO additions)?

- Paid for Long-Term Care Insurance?

- Did you Donate to a Health Care Sharing Facility?

- Bring Jobs Home?

- Transportation Facilities Deduction?

- First Time HomeBuyer Savings Account?

- Do you have any of these items, Not Taxed by Missouri (see list)?

- Savings for Tuition Programs

- Qualified ABLE?

- Agriculture Disaster Relief?

- Taxes Paid to Another State?

You can elect to have your credit direct-deposited into your account, or you can print and mail the form to have a check mailed to you.