- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why are my GA state taxes so high!? i'm a consultant from CA and worked a project last year in GA for a total of 3-4 weeks (tops), but have nearly $1000 in taxes, WTF?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

Take a look at your GA return. Is more than your GA income showing taxable? Follow these steps:

- on the left side go to Tax Tools

- click on Tools

- Pop up box, click on View Tax Summary

- left side, click Preview my GA

You can reply with any issues you see.

You are also welcome to use Turbo Tax chat.or you can fill this form out for someone to call you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

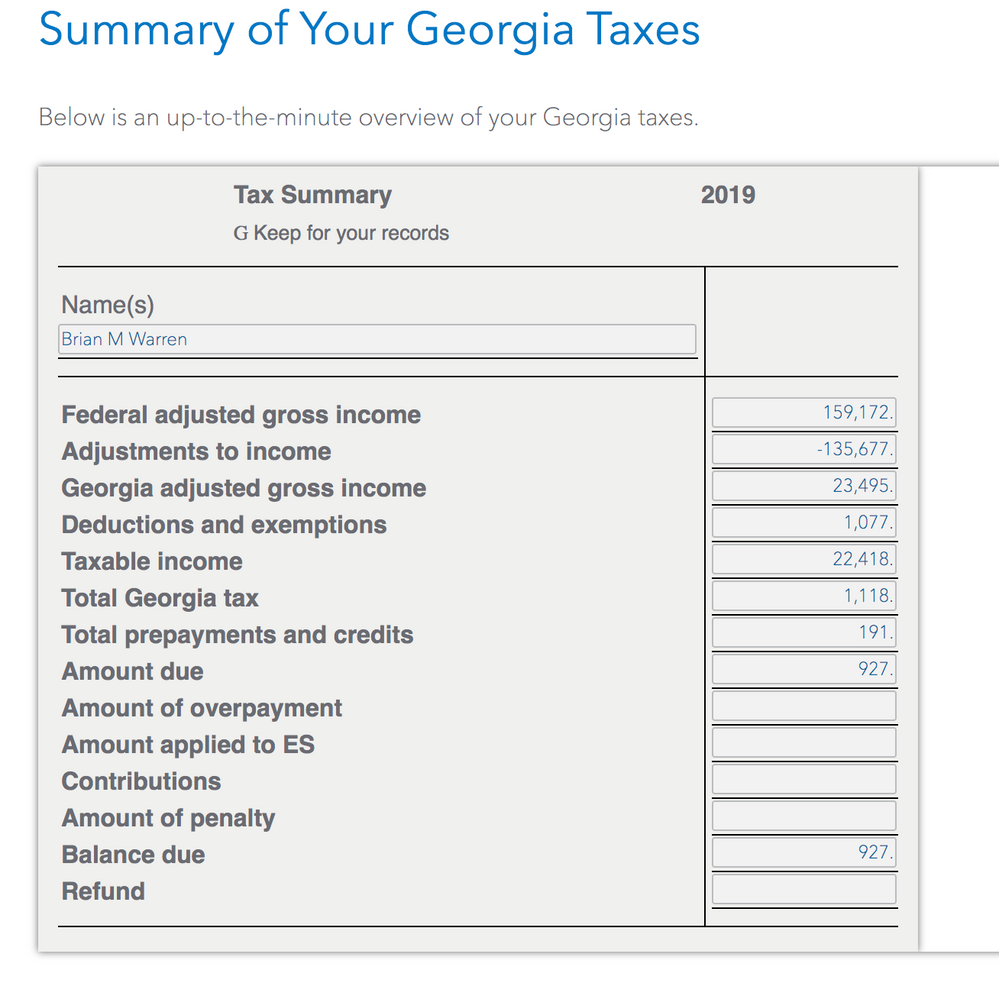

i think so... see screen shot of the GA tax summary below. I didn't make $23,495 in georgia last year. my W2 only showed $4,158.39 as GA state wages (box 16). maybe its considering my 1099s income as income made in GA?

Is my suspicions above correct? How do i fix this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

When you go through GA, it asks about every bit of income you earned and asks you to allocate it to GA or other state. Please go back through and review those entries. It is time consuming to go through everything on the return; but, clearly worth it.

If you are still unable to correct the problem, there is a cheat but it should be last resort. On the Here's How Georgia Handles Income Differently screen, the bottom selection is for GA subtractions from income. You could enter NON GA MISC and the amount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

i've fixed the issue and allocated the income to "other states" (i.e. CA) such that my GA taxable income is aligned with my W2. however in fixing this problem, my CA tax has sky rocketed! It's less that i have "fixed the issue" and more that i have just moved the taxes from the GA return to the CA return.

Is this the way it is supposed to be? it looks like all my income from stock sales is being taxed by the federal government as well as CA. Is this right? or is there a way i can make the similar adjustment as with the GA tax return so that this income is not taxed twice?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

Yes, you do need to pay capital gains to the federal government as well as the state. The reason that all of your capital gains appear on your Ca return is because your disposal date for the stocks occurred when you lived in California.

**Mark the post that answers your question by clicking on "Mark as Best Answer"