- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

Go back to the Federal section of the program.

- Select Income & Expenses

- Select "IRA,401(k), Pension Plan Withdrawals (1099-R)

- Select "Edit" under the appropriate 1099-R form

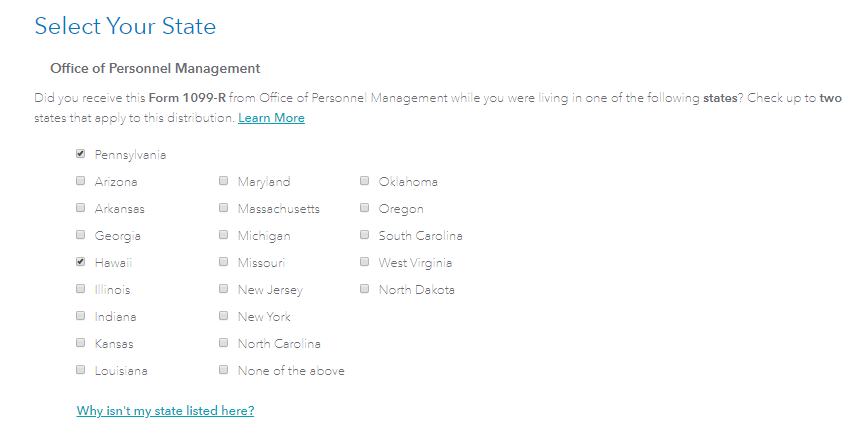

- Proceed to answer through the screens until you see "Select Your State". (You should see this after enter your details from the 1099-R, and the question asking if you are a public safety officer.

Be sure you select Oregon in the section above.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 7, 2020

3:22 PM