- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

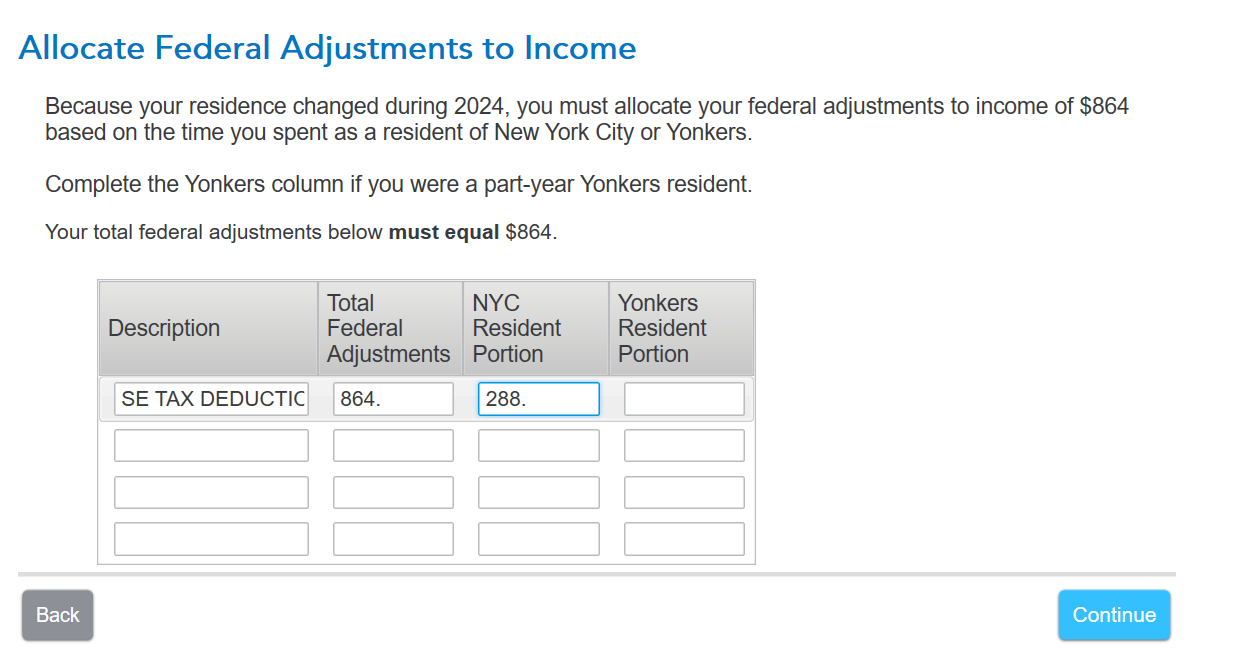

Your adjustment to income is the SE tax deduction in the amount of $864.

If you earned this self-employed income throughout the year, then you should allocate $288 (4/12 months x $864) for NYC based on the residency dates you entered into TurboTax. If you didn't earn this income throughout the year, then allocate accordingly.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

April 16, 2025

11:47 AM