- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

Maybe.

"If you were a part-year resident of North Carolina during tax year 2024 and you received income while a resident of North Carolina, or you received income while a nonresident that was attributable to the ownership of any interest in real or tangible personal property in North Carolina, or derived from a business, trade, profession, or occupation carried on in North Carolina, or derived from gambling activities in North Carolina, and your total gross income for 2024 exceeds the amount shown in the Filing Requirements Chart for your filing status, you must file a 2024 North Carolina individual income tax return, Form D-400."

North Carolina Department of Revenue - Individual Income Filing Requirements

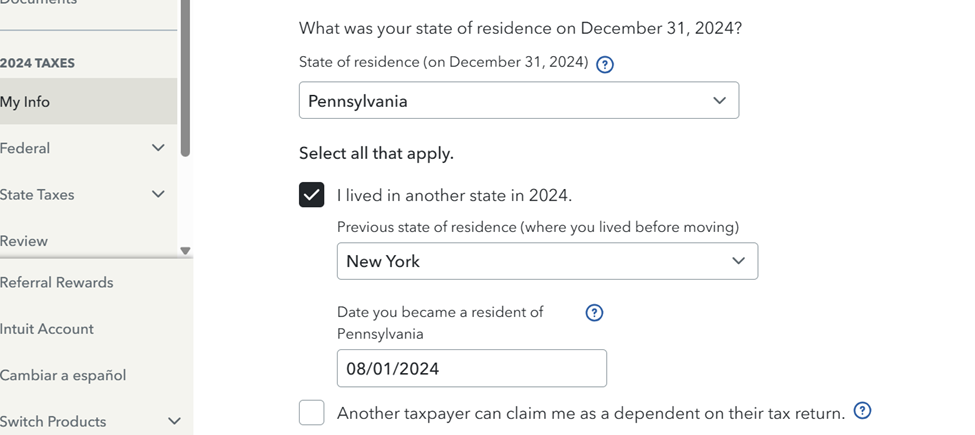

Just be sure to fill out your "My Info" section correctly. Your financial information will flow correctly to the appropriate state tax returns (after your federal return is completed). See example image below.

After you finish entering your federal return info, you'll automatically move to the State Taxes section, where you'll see your part-year states listed. Prepare the return for your former state first, followed by the return for the state you currently live in.

**Mark the post that answers your question by clicking on "Mark as Best Answer"