- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to determine state tax when W2 says it's higher than federal wages

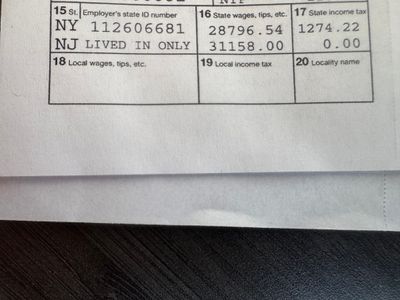

I worked in NY, but lived in NJ. From my W2, it says the following:

- Federal wages (box 1): $28,796.54

- NY wages (box 16): $28,796.54

- NJ wages (box 16): $31,158

I am confused why my NJ wages are higher than the federal/NY wages. When I submit my NJ state return, what should I put as state wages?

March 22, 2025

9:09 AM