- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

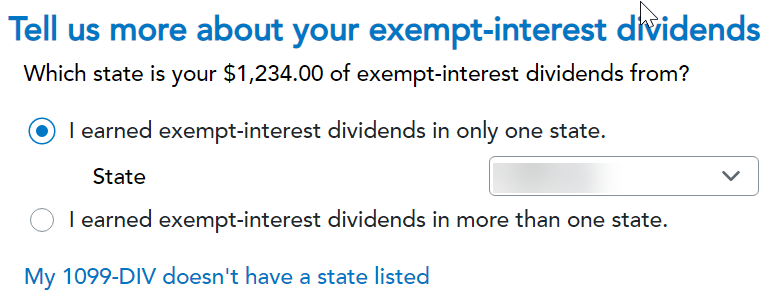

When you enter Form 1099-DIV in the Federal section of TurboTax, the steps are as I detailed in my post from last year to which you refer. See screenshots below:

The next step is:

The step after that is:

These screenshots are from Desktop but Online follows the same steps.

The IRS instructions for Schedule B state, under tax-exempt interest:

Also include on line 2a of your Form 1040 or 1040-SR any exempt-interest dividends from a mutual fund or other regulated investment company. This amount should be shown in box 12 of Form 1099-DIV.

The instructions for California Schedule CA state:

Certain mutual funds pay “exempt-interest dividends.” If the mutual fund has at least 50 percent of its assets invested in tax-exempt U.S. obligations and/or in California or its municipal obligations, that amount of dividend is exempt from California tax.

Make any needed adjustments to your states in the state return section.

**Mark the post that answers your question by clicking on "Mark as Best Answer"