- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

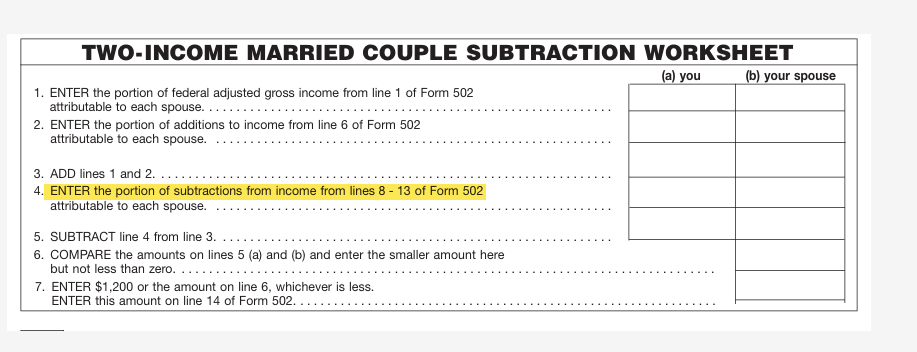

I don't believe so. I'm not sure what credit you are referring to, but a credit would be applied to a tax, not to income. For the two-income subtraction from income, you are required to reduce each taxpayer's federal adjusted gross income to account for subtractions from it, but that would not involve tax credits:

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 4, 2025

12:38 PM