- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

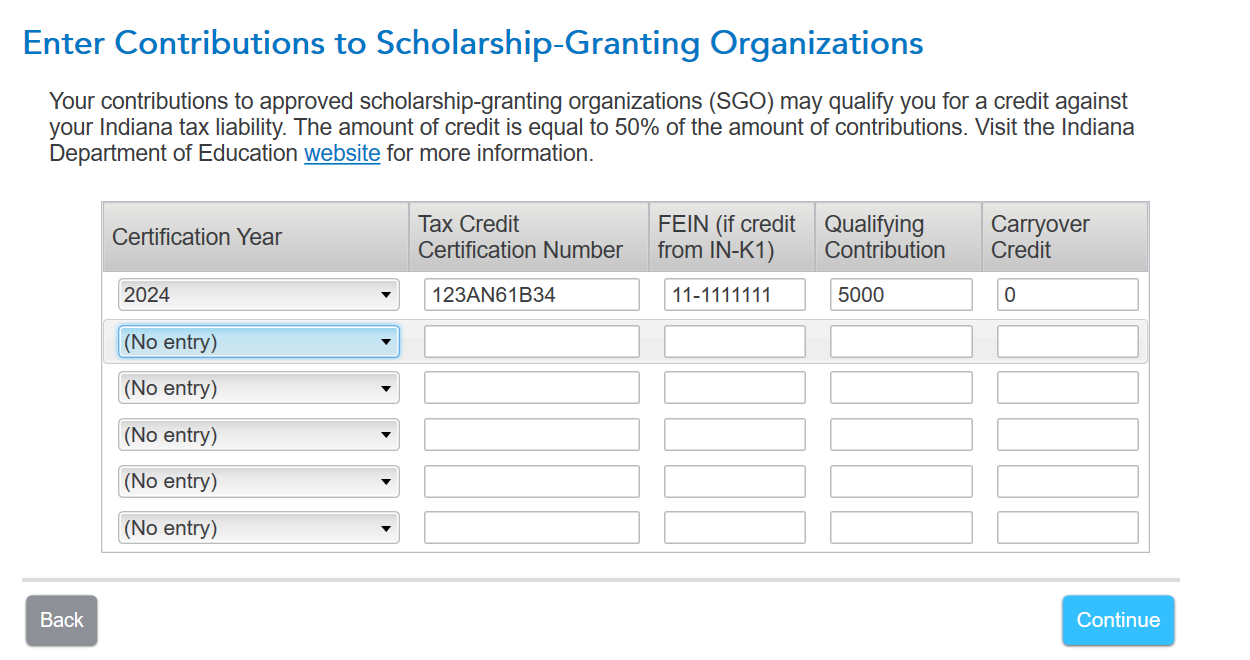

Please follow the instructions below to enter the certificate number for Schedule IN-OCC:

- Open your Indiana return.

- Continue through the screens until you reach Take a look at Indiana credits and taxes.

- Scroll down until you get to the particular credit you are taking on Schedule IN-OCC. Click Start.

- Enter the information on the following screen, including the Tax Credit Certification Number.

Schedule IN-OCC reports the following credits:

- Hoosier Business Investment Credit

- Hoosier Business Investment Credit – Composite

- Hoosier Business Investment Credit

- Logistics 860 Hoosier Business Investment Credit – Logistics – Composite

- Natural Gas Commercial Vehicle Credit

- Natural Gas Commercial Vehicle Credit – Composite

- Redevelopment Tax Credit

- Redevelopment Tax Credit – Composite

- School Scholarship Credit

- School Scholarship Credit – Composite

- Venture Capital Investment Credit

- Venture Capital Investment Credit - Composite

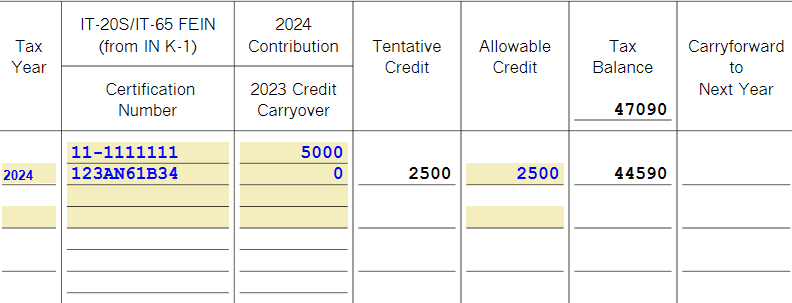

I completed a mock return and was able to add a certification number for the School Scholarship Credit on the screen shown below. I tested other credits as well, but this seemed to be one of the few that required a certification number. This information flowed correctly to Schedule IN-OCC and I encountered no issues.

If you need additional assistance, please reply in the thread with the credit you are having trouble adding.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 10, 2025

5:38 AM