- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Claim NYS credit for taxes paid in California - part time resident

I moved from califronia to new york. I'm filing a part time resident for each state. However when I moved my payroll didn't withhold for new york until the the new year of 2024. I moved Oct 1 to NY from CA.

I'm checking to see if its it allowed to claim tax credit when the tax owed is less than tax payed ? I got a refund in california since I overpaid taxes for income earned in NY, but when filing for NY I have massive tax bill and i want to offset that with the taxes already paid by california for that specific NY income

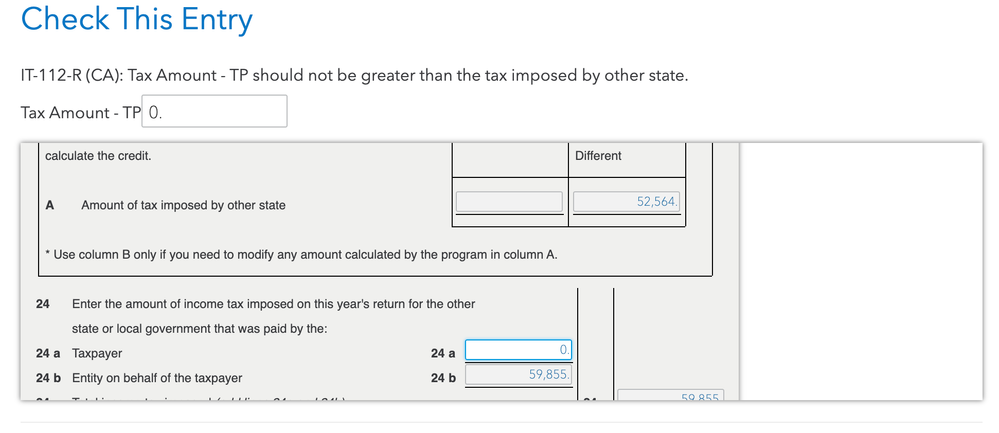

However getting and error in turbotax that Taxes paid must be lower that taxes owed

Topics:

April 14, 2024

6:26 AM