- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

NY Business and Investment Credits - Is it for capital losses from stocks?

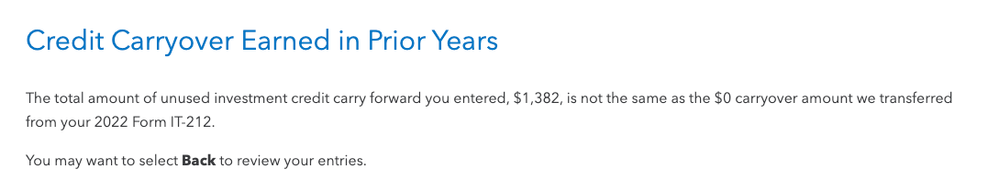

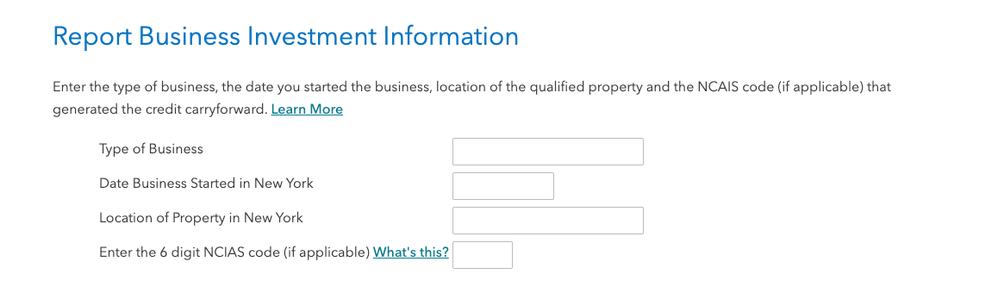

For the state of New York (NY) taxes, is the Business and Investment Credits used for Capital Loss Carryover? I had a capital loss from stocks carrying over of -$1,382, but when I enter this amount it gives me a warning and then starts asking about the type of business. This is a bit confusing because I was just carrying over losses from stocks.

In my Federal Taxes, the capital loss carryover seemed to automatically work based off my last year Turbotax.

Topics:

April 6, 2024

1:12 PM