- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to find Double-taxed income from IT-203 non-resident NY state form - line?

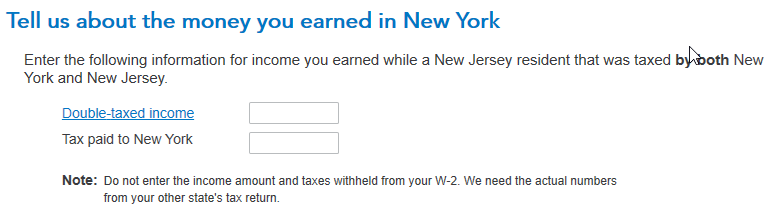

Tax situation: Living in NJ state and working in NY state, filing NY state IT-203 to NY state and NJ state resident form with NJ-COJ. Completed Federal, NY state; now working on NJ state, turbotax screen for "New Jersey" asking me to enter "Double-Taxed Income" and "Tax paid to New York" amounts - which line amounts to be put in from IT-203 form?

-Is it line 31 New York state amount (or) line 32 (or) line 33 to 37 lines, which line# we can take it as DOuble-Taxed income?

-Which line# amount (line 38 to line 50) is for Tax paid to new York?

Standard deduction.

Not sure why it's not populated, but no addl. helpful info on "DOuble-taxed income" link. Looking for clues & guidance. Thanks

.