- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

That doesn't apply to you. PA doesn't treat your compensation as PA-sourced income if you are a nonresident employee required work remotely in another state. Review the PA Department of Revenue Telework Guidance.

You won't have to file a PA tax return unless your employer withheld PA taxes.

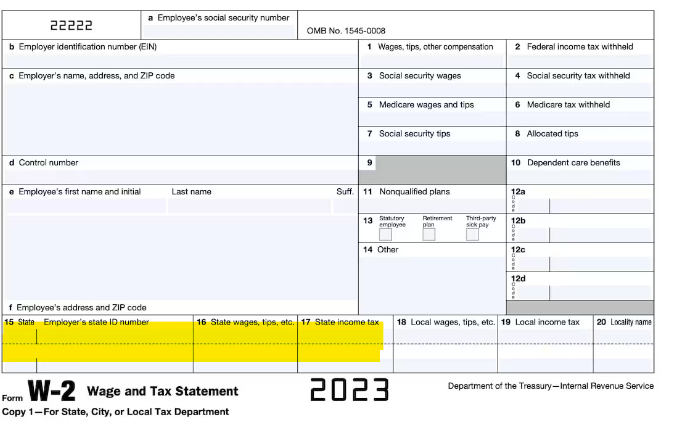

PA wages and withholding would be in boxes 15,16, and 17.

[Edited 3/2/24|8:06 PM]

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 2, 2024

7:44 PM