- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

If you're entitled to the exclusion, review the input of your civil service Form 1099-R. To do this in TurboTax Online:

- If you don’t see 2022 TAXES in the left pane, select the dropdown to the right of Income & Expenses on the Hi, let’s keep working on your taxes! page and then select Let’s get started, Pick up where you left off, or Review/Edit.

- Otherwise, in the left pane, select Federal, then Wages & Income (This is labelled Income & Expenses in TurboTax Self-Employed

- Scroll down and select Edit/Add to the right of IRA, 401(k), Pension Plan Withdrawals (1099-R)

- On the Here's your 1099-R info screen, select Edit to the right of your civil service 1099-R

- Proceed through the screens, making any changes necessary

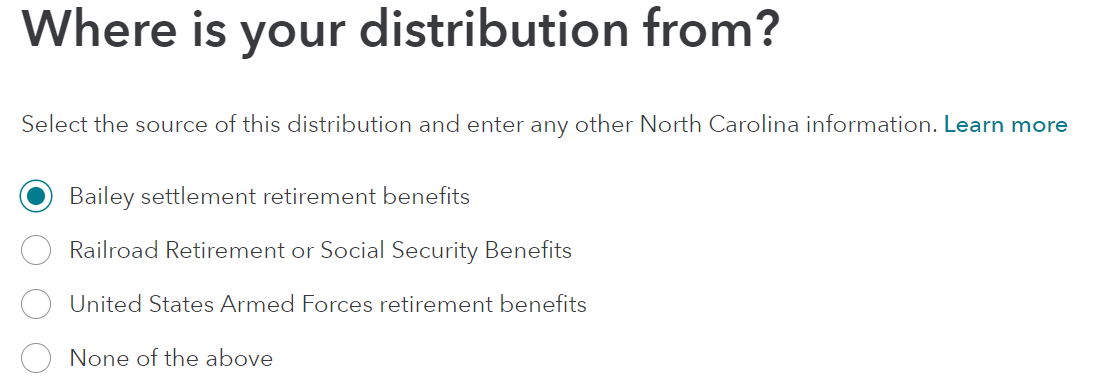

You should encounter this screen when inputting your civil service Form 1099-R:

If you're entitled to the exclusion, you should select Bailey settlement retirement benefits.

Certain civil service retirement income is excludable on your North Carolina state return. You can deduct Bailey, Emory, and Patton settlement benefits from your North Carolina income. This applies to federal or North Carolina government pensions if you qualified before August 12, 1989.

According to Line 20 [Schedule S], Retirement Benefits Received by Vested N.C. State Government, N.C. Local Government, or Federal Government Retirees, i.e. Bailey Settlement in the Form D-401, Individual Income Tax Instructions, the Bailey Settlement exclusion applies to retirement benefits received from certain defined benefit plans, such as

- The North Carolina Teachers’ and State Employees’ Retirement System

- The North Carolina Local Governmental Employees’ Retirement System

- The North Carolina Consolidated Judicial Retirement System

- The Federal Employees’ Retirement System, and

- The United States Civil Service Retirement System

if the retiree had five or more years of creditable service as of August 12, 1989.