- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

I think you are all missing the real question and why it is such an impact to your return. Let me try to shed some light on what the question is trying to do.

As resident of NY, NY will give you a credit for income that is being double taxed by both NJ, CT, any other state and NY. However, NY will only give you a credit equal to the lowest state tax on the amount.

Because NY taxes your full income and then prorates for the NY amount, it is often higher than the other state tax.

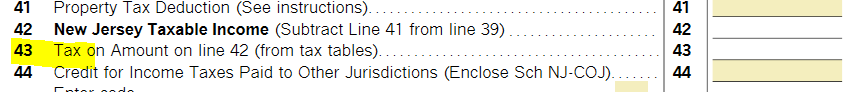

To determine your correct tax deduction, you can look at the nonresident tax form, locate the tax liability - not what you paid in through withholdings. The tax liability on the income is the number that should be entered when asked about your non-resident tax liability.

@priscilla24 @Rayy @tfz2101 @Anonymous50

**Mark the post that answers your question by clicking on "Mark as Best Answer"