- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

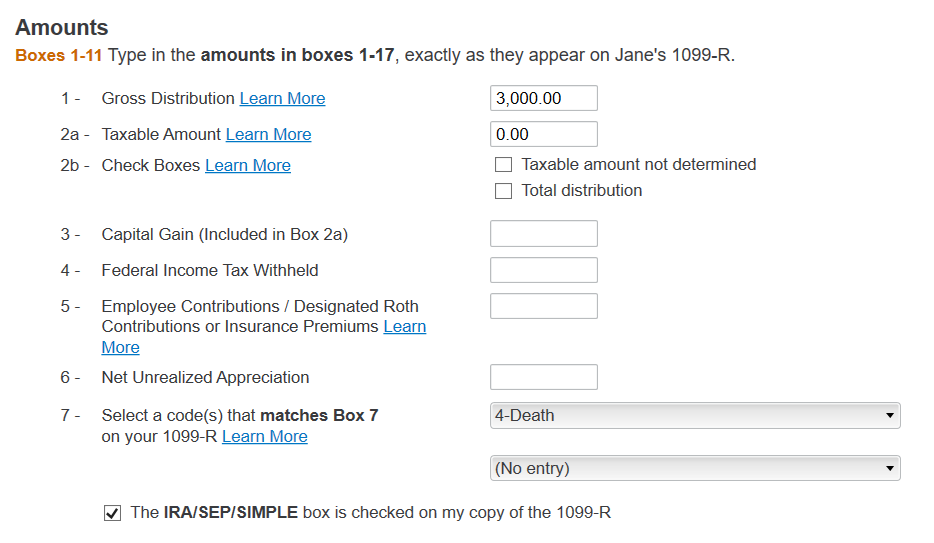

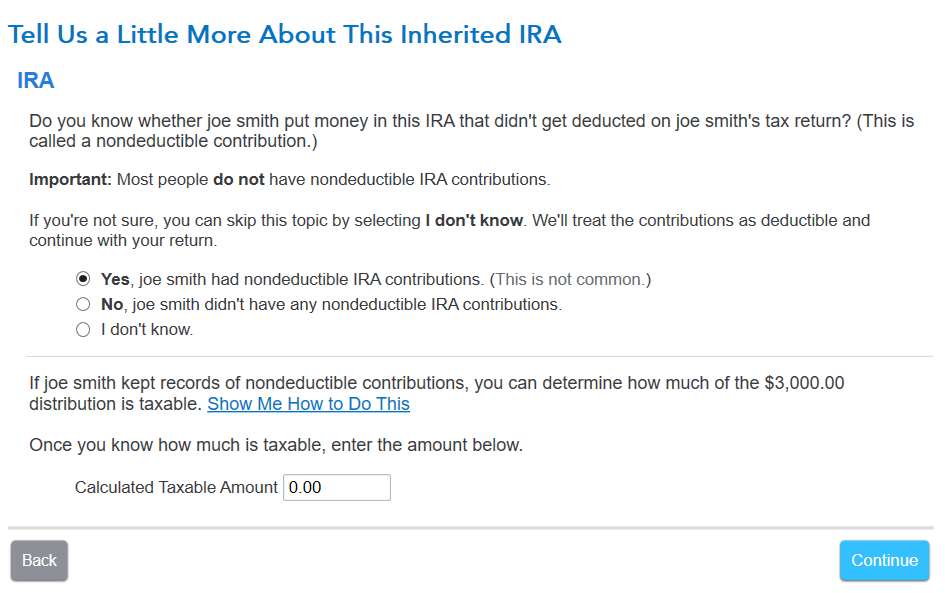

I am trying to duplicate your situation. I assumed code 4 and nonspousal IRA with MA tax paid on original contributions. When I enter the 1099R, I used a code 4 in box 7 since it is a beneficiary. I marked that it was non-spousal. I entered nondeductible IRA contributions existed. The calculated taxable amount is zero such that nothing is taxable on the federal.

When I go to MA adjustments, it shows the amount I entered as the basis showing in previously taxed by MA. Of course, if the IRA did not have MA taxes paid previously, the IRA would be taxable to MA.

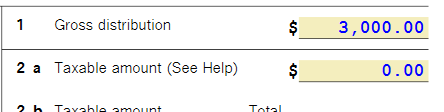

When I look at the federal worksheet for the 1099-R, it has filled in the taxable amount as $0 when I had left the box blank on purpose during the interview, not knowing what you had done.

In MA, the return begins with the federal income on page 1. Income is added and subtracted according to state law. Schedule X contains the other income and I see where it is part of the total on line A but not on line H for taxable other income.

If you need additional help, please reply with more information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"