- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

Yes, the program will suggest a number that is based on the actual tax liability for the other state. The number you enter for line 24a should be no more than the suggested number.

To review this screen In TurboTax:

- Open your return, click on State Taxes, then Your State Returns.

- Select Edit to the right of New York.

- On the screen, You Just Finished Your New York Return, scroll down and find Credits and other taxes, click Update to the right.

- Click Update to the right of Taxes Paid to Another State.

- Click Edit to the right of the other state.

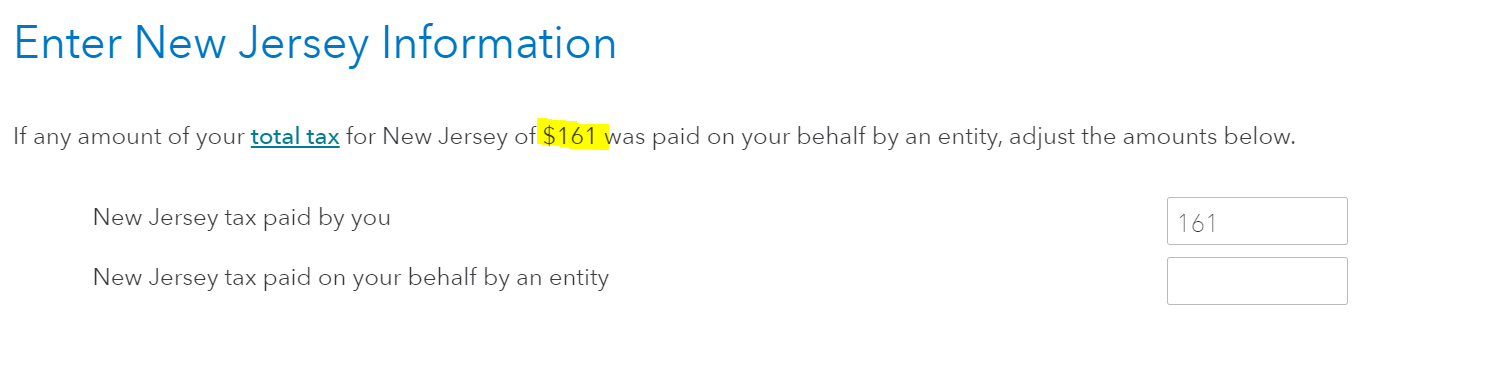

- On the screen Enter (other state) Information, enter the tax paid by you, but no more than the amount shown as the total tax. See the image below.

- Continue and Review the return.

I think this is the same error for all of you, but if you are still having trouble, please respond back with more details, including the name of the other state.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 27, 2023

10:24 AM