- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

To review/edit your 1099-INT:

- In TurboTax, type 1099-int in the search box and click on the Jump to 1099-int.

- On the Your investments and savings screen, scroll down to the 1099-INT and Edit/Review.

- On the Let's get the info from your 1099-INT screen, under Box 1 - Interest income, put a check mark in My form has info in other boxes (this is uncommon). You'll be able to enter Tax-exempt interest in Box 8.

- Continue through the interview. On the Tell us more about your tax-exempt interest screen, enter Minnesota from the drop down menu and Continue through the onscreen interview until complete.

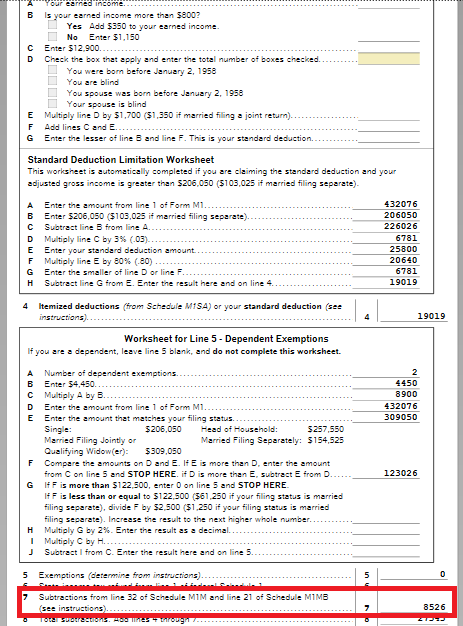

On your MN state income tax return, the tax exempt interest will transfer to Form M1 Line 7 Subtractions from line 32 of Schedule M1M and line 21 of Schedule M1MB.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 22, 2023

2:03 PM