- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

You state that the program says you do not owe estimated taxes. I believe you didn't fill in the expected income for 2023 in one of the many boxes. I created a return to owe IN tax, went through estimates for 2023 and it divided up the amount due among the 4 quarters.

To verify, these are the steps:

- Estimated taxes for 2023? you clicked YES, filing status, residency, and then you entered your expected income for 2023.

- Next, exemptions and income allocation for 2023

- then choose your payment option, do not select no estimates

- Report payments already made, either all blank for 2023 or you may have made the first payment.

- Choose next payment date, either the top option if no payments have been made or the second option if you made a payment already.

- Select rounding,

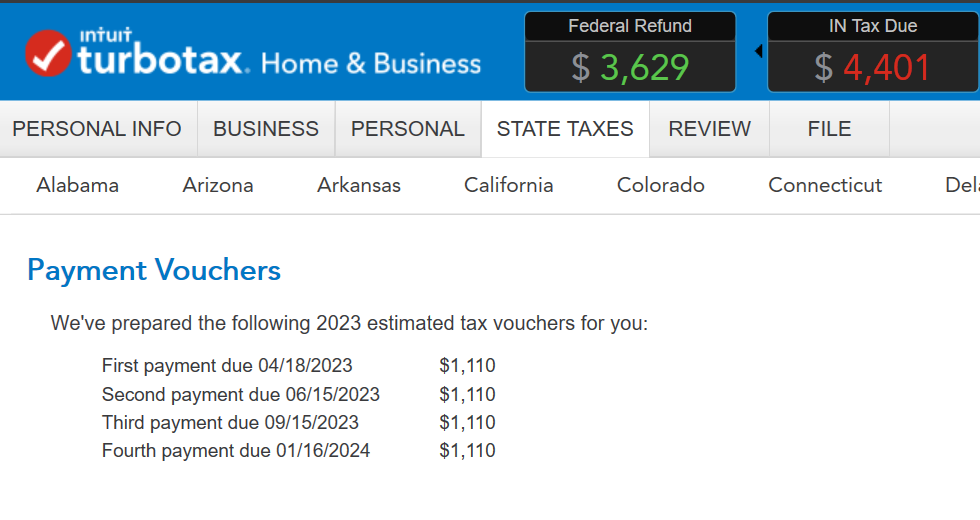

- vouchers show up by quarter.

- Click print vouchers and they preview with the amounts listed on the screen.

Another option is to pay your estimated taxes online.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 14, 2023

3:22 PM