- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

There is a bypass to uploading the 1099-B for PA purposes but it most likely entails deleting and re-entering the information on the 1099-B into the Federal Area.

Instead of stating that you have more than 3 transactions, if that is what you did, follow these steps:

- In the Wages & Income section click on Edit/Add at Investments & Savings

- Locate the transactions listed that are in need of re-entry and click on the trash can deleting them.

- Click on Add Investments, then "Continue", then "Enter a different way"

- Click on the Stocks, Bonds, Mutual Funds box and then Continue

- Enter the data of the issuing agency, you stated STASH, along with you account number and their identification number, although those are not required

- Click Continue

- Answer the questions on the screen, first is normally no, then answer no again for number of transactions, and then no again, and finally yes, and Continue.

- Click on "One by One", but you will be answering from the sales section totals, click Continue, then Continue again

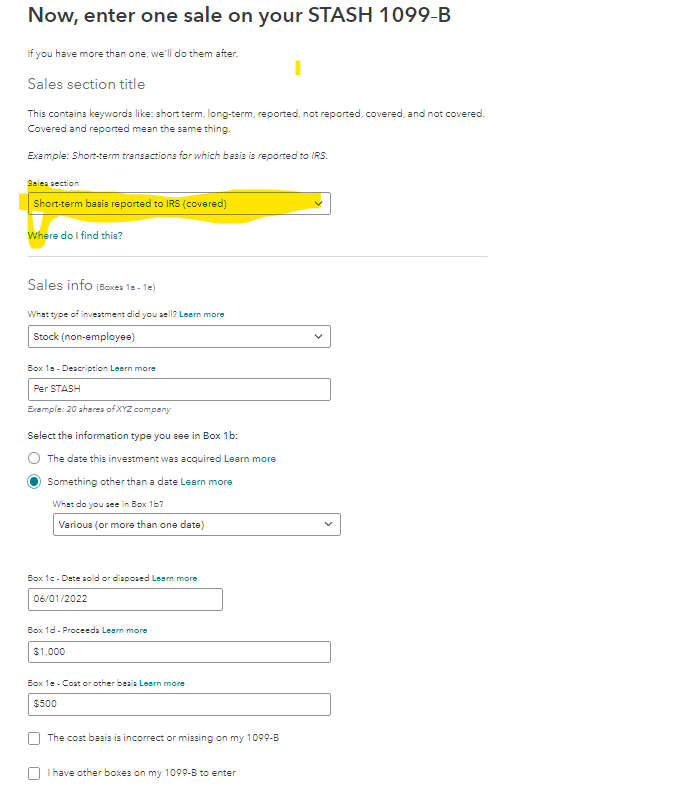

- Enter your transactions by section as if they were just a single transaction. The example below should be of assistance:

Click Continue, answer the following question, and then repeat the process for the other sections of your 1099-B

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 14, 2023

7:29 AM