- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

State tax filing

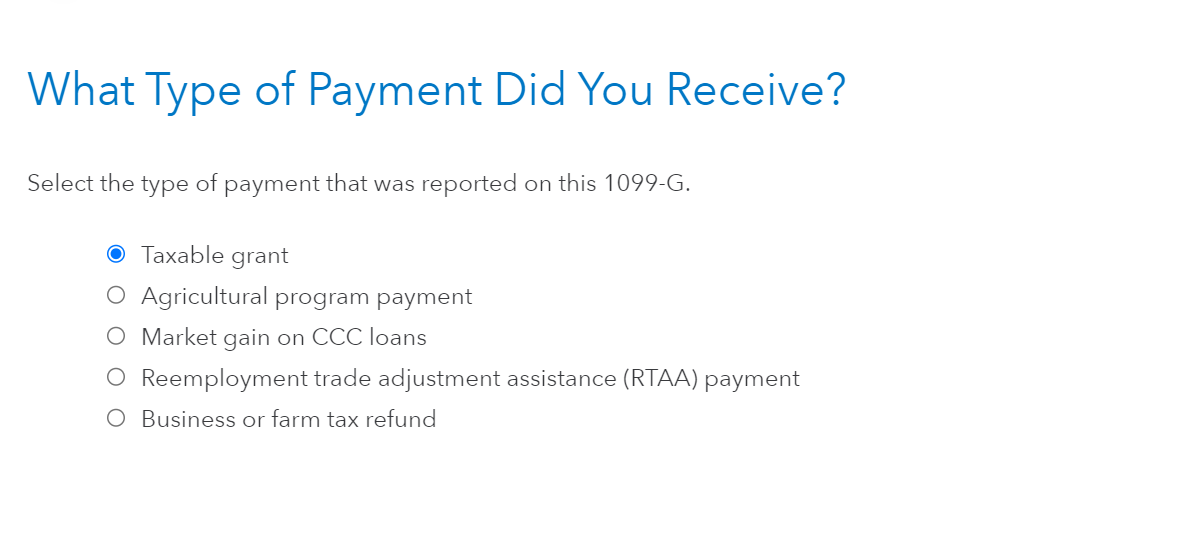

The RTAA is listed under other common income; follow these steps to confirm that the selection did not default when you entered your "Other 1099-G":

- Click Wage and Income

- Click revisit beside Other 1099-G Income

- Click Edit beside each 1099-G you have listed in this section and check the following:

- Indicate who received the 1099-G

- Verify the address, click continue

- Verify the type of payment; RTAA will be listed here as an option

Here is a screenshot of where the RTAA selection is made:

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 7, 2023

12:10 PM