- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Live in PA, Worked both in NY and PA. Should I select Not Taxable for NY income on the PA Form?

I live in PA and worked in NY from JAN 1 2022 - March 31 2022. Now I worked in PA from April 1 2022 to present.

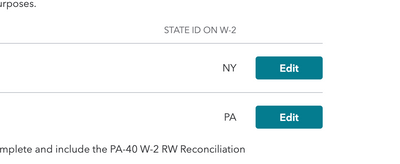

When I generate my PA taxes, it includes the NY and PA taxes in the Compensation Summary page below.

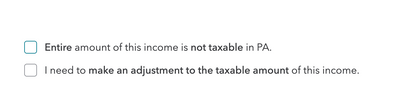

I generated my Non-Resident NY first, now the PA Resident. In the PA Resident form, should I select "Entire amount of this income is not taxable in PA." for the NY income since it was not earned in PA? This allows me to get a refund for the difference in Credit. I just want to make sure, because then PA takes my total Gross of NY and PA.

Topics:

January 29, 2023

11:37 AM