- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

Yes, your employer is correct. If you do not use the funds, you forfeit them to the plan.

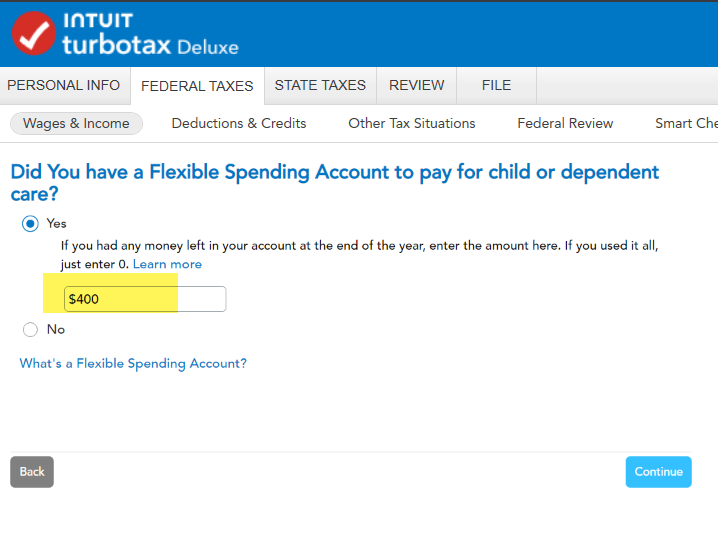

When you enter your W-2 into TurboTax, you will enter the $400 from Line 10. Since you forfeited the $400, you will not be taxed on it. You will need to file Form 2441. After entering the information in your W-2, continue though the interview. When you are asked, Did You have a Flexible Spending Account to pay for child or dependent care?, answer yes, and enter $400 was left in the plan at the end of the year. Now, Form 2441 should have $400 in lines 12 and 14, leaving a taxable benefit of $0.

Here is an article you may find helpful: Flexible Spending Accounts

March 10, 2025

6:00 AM