- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

Yes, you should delete all the separate 1099-NECs you entered. Since you are a sole-proprietor, you will enter this income in the self-employment section, which gets reported on Schedule C.

In order to report the income from your 1099-NECs, here are the steps:

- Navigate to Federal > Wages & Income > Self-employment income and expenses > Add/Edit

- Edit your business

- Scroll to Income, then select Add income for this work

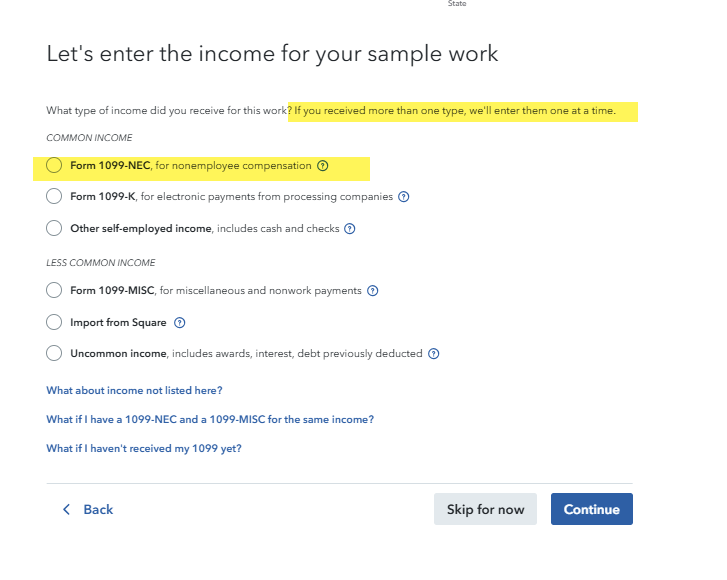

- Choose 1099-NEC as the type of income and answer the interview questions that follow.

March 1, 2025

1:51 PM