- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why was my amended 1040X rejected?

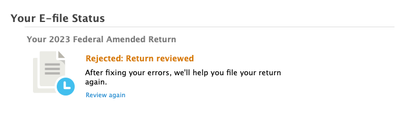

IRS rejected e-file of Amended 2023 return.

Filed Amend return 1040x to reflect 403(b) excess deferral. Followed the instructions https://ttlc.intuit.com/community/retirement/discussion/re-i-have-made-excess-401k-deferral-in-2023-...

No errors from TurboTax, submitted e-file and got a "rejected by IRS", but no error codes nor errors upon further turbotax review. Any suggestions? (besides mailing the 1040X to the IRS) 🙂

April 7, 2024

9:20 PM