- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

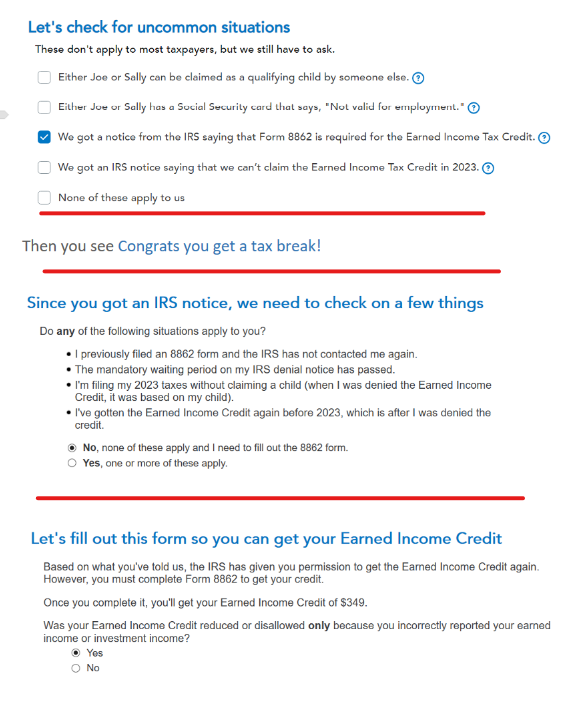

To ensure you can e-file the return and attach Form 8862 to get your Earned Income Tax Credit, go through the EITC interview under You and Your Family in the Deductions and Credits section. You will be asked about uncommon situations. You have to put a checkmark in the box that says 'We got a notice from the IRS saying Form 8862 is required'. Mark that box, proceed through the interview.

After the screen that shows you qualified for the credit, you will be asked to complete the form. To fill out 8862, you will need to answer NO on the we need to check a few things screen. Then on the next screen, you have to answer YES to Was your EIC reduced or disallowed only because you misreported your earned income? After that question, Form 8862 will be attached to your return. If you get rejected again, let us know the message.

**Mark the post that answers your question by clicking on "Mark as Best Answer"