- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

Hi Marilyn,

I really do appreciate your help on this. I will contact TurboTax help, but I have a couple more questions for you.

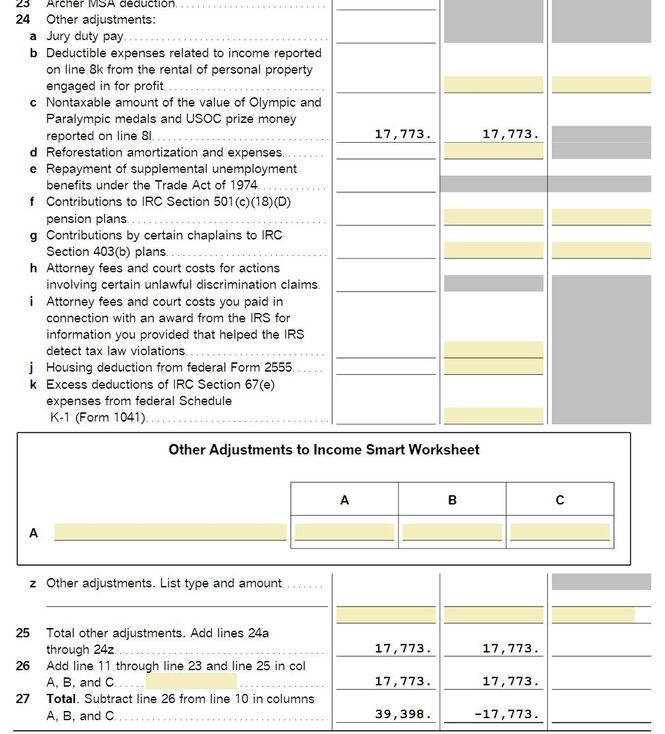

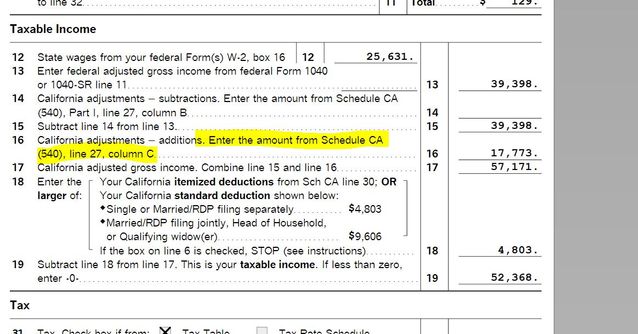

I agree that line 16 on form 540 is from Line 27, Column C. Please see my original screen shot that shows $17,773 has been added to line 16 and if you see the screen shot below of Schedule CA, that number does not exist in line 27 Column C. It appears that TurboTax is getting it from Column A or Column B line 25 or 26 but not line 27.

Does that make sense? Am I missing something?

Just FYI, in the chat with FTB last year (using different numbers), here is the response.

"Dustin[1:47 PM]:

So if the IRS does not tax that you would leave that out of Column A since the IRS is not taxing that portion and then the taxable amount to CA would have been the $27,409 in column C. So line 9 column A should have been $20,154 and then line 9 column C would be the $27,409 for a total income of $47563"

Any help you can provide is appreciated, including how I should phrase my question to TurboTax help.

Thanks again,

Mary Ann

Original screen shot of form 540