- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received Corrected W2 after filing taxes

Hello Community,

I would really appreciate your help with the following issue.

Background:

I live in Madison, WI, and work for an organization in Minneapolis, MN. I started this job in the middle of the pandemic in 2020 and started working from home (Madison, WI) and did not visit the office (in Minneapolis, MN) even once.

Initially, I received the W2 from the employer in which column 15 state was 'MN'. I filed my 2020 taxes and received a refund as well.

This week, my employer told me that there was an error in the W2 and I should be paying Wisconsin state taxes and NOT Minnesota state taxes due to the ''WITHHOLDING TAX UPDATE' by the state of Wisconsin (document: https://www.revenue.wi.gov/withholdingtaxupdate/20-1.pdf).

Thus, I got a correct W2 (W2C) from my employer with column 15 updated to 'WI' (previously it was 'MN'). This is the only change in the W2C.

My Question:

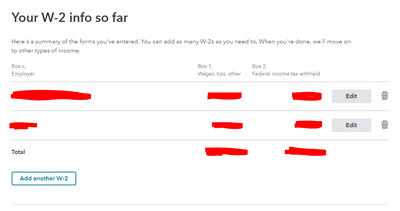

1) While following the steps, I have reached a point in the TurboTax online amendment process where I am not sure if I should Add the W2C or Edit the existing W2? There is an option to ADD W2 and I can edit the existing W2 as well, what should I choose?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

since you efiled you need to amend. in interview mode you enter only the info that changed which would be to delete the old state info and enter the new state info. you'll need to file amended returns in MN to get back w/h and file in Wi to report your additional income and w/h

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

Mike,

Thank you for the response.

I am not sure what you mean by 'interview mode'.

As previously mentioned, I am following the steps on TurboTax online amendment process and now reached a point where I am not sure if I should Add the W2C or Edit the existing W2?

There is an option to ADD W2 and I can edit the existing W2 as well, what should I choose?