- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

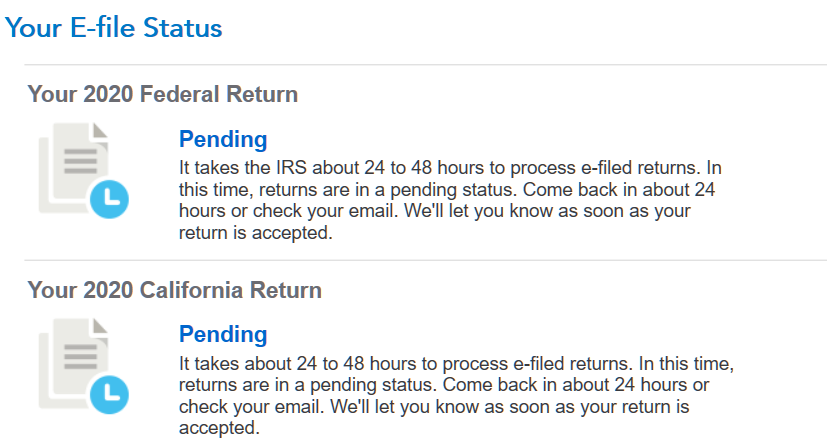

E-mail your Intuit execs about the Pending Status discrepancy:

Their software is misleading about a 24-48 hour lead time to process e-filed returns. If it's not actually their "fault" for the Pending Status delay, then they should at least provide a more accurate representation/characterization in their software. Maybe say, "normally, it takes 24-48 hours to process e-filed returns once returns begin collection by the IRS, but it may take longer if the IRS doesn't pull certain returns from us. We'll contact both you and the IRS if you still have pending status in 2 weeks". The reps will just blame the pandemic, IRS etc. and tell you to wait longer

Contacts:

[removed]

February 17, 2021

11:51 AM

2,308 Views