- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

If you do not receive your second stimulus payment you start by checking so see if the IRS has processed a payment for you.

Go to IRS Get My Payment and put in your information.

If it indicates that a check or debit card has been mailed to you, then continue to watch your mail.

If you do not receive a second payment then you will file for the payment on your 2020 taxes.

Since your taxes are pending, you will have to wait to see whether the IRS accepts your tax return. They will start accepting returns on February 12, 2021.

If your return is rejected, then you can edit your return and claim the Recovery Rebate Credit

If your return is accepted, then you will wait until the IRS has processed your return and then file an amendment to claim the Recovery Rebate Credit.

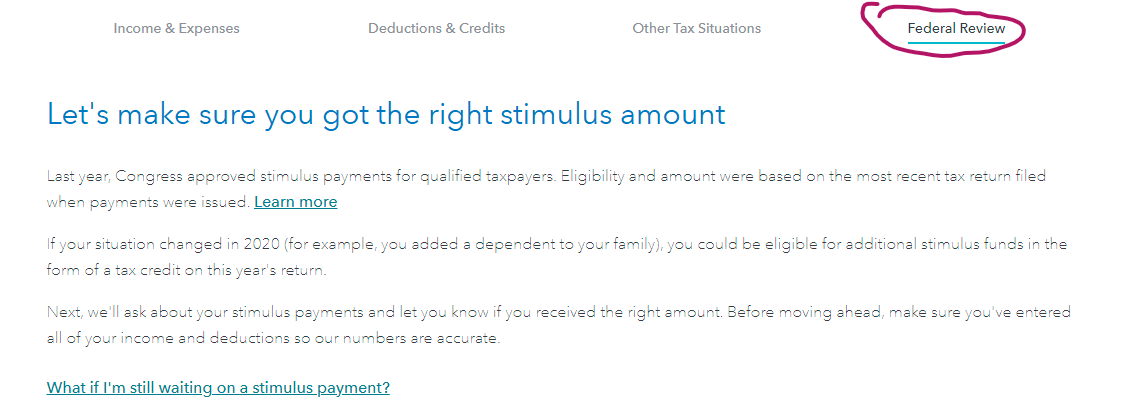

The quickest way to get to the Recovery Rebate Credit on your return is to click Federal Review at the top of your online TurboTax screen