- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

Everyone needs to realize that INTUIT that puts out the DIY income tax program and has nothing to do with the GreenDot card that only has the TurboTax name on it for advertising. Asking these questions about what will happen with the GreenDot card on the TT forum is not going to produce an answer you like.

That said ... other Greendot users who did use the refund processing service HAVE reported getting notification from the debit card of the pending deposit ... so all you can do is wait for your notification to come. NO ONE on this forum can tell you anything concrete about your situation.

If you have already filed a 2019 return there is nothing you can do until something happens on the IRS side… and they are ahead of schedule which is evidenced by the test deposit notifications some saw over the weekend.

If you get the DD in the next 2 weeks then you are done.

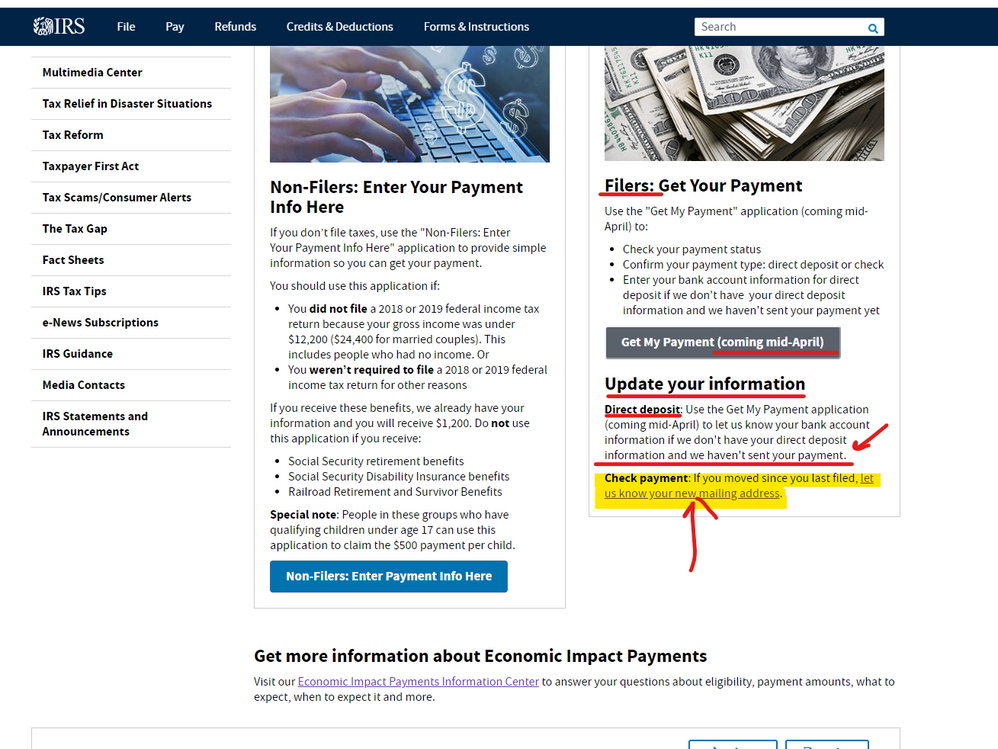

If you do not get the DD by the time the IRS finally opens the promised portal (now expected by 4/17) then you can check on the status and/or update your information at that time. https://www.irs.gov/coronavirus/economic-impact-payments

https://www.irs.gov/coronavirus/economic-impact-payments

To help everyone check on the status of their payments, the IRS is building a second new tool expected to be available for use by April 17. Get My Payment will provide people with the status of their payment, including the date their payment is scheduled to be deposited into their bank account or mailed to them.

An additional feature on Get My Payment will allow eligible people a chance to provide their bank account information so they can receive their payment more quickly rather than waiting for a paper check. This feature will be unavailable if the Economic Impact Payment has already been scheduled for delivery.