- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

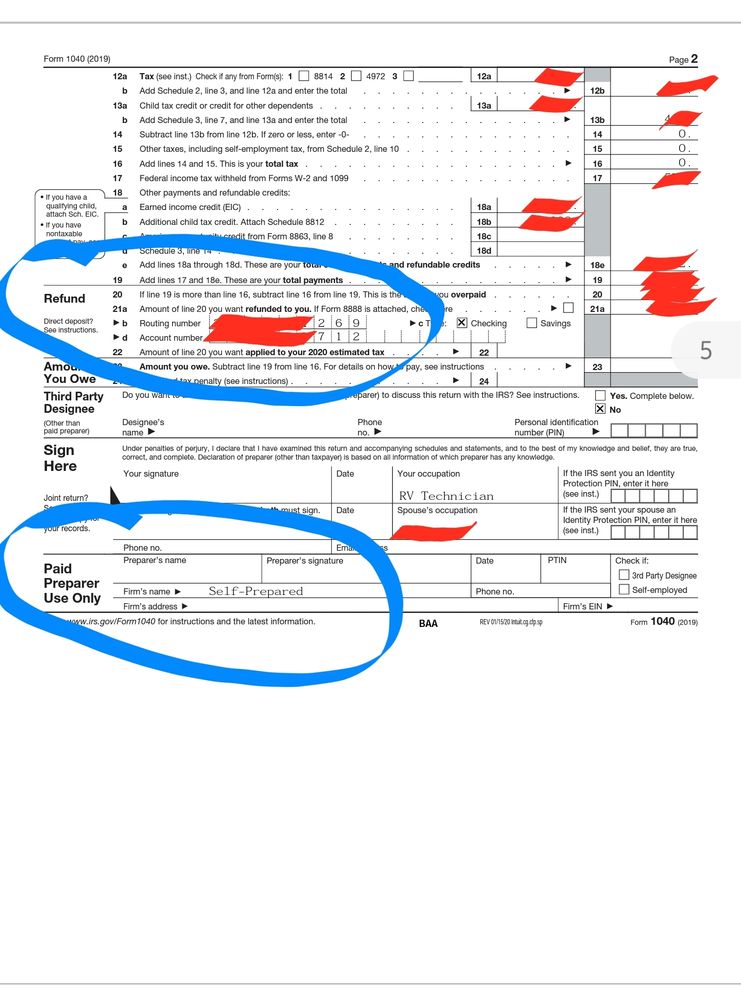

The best thing to do, would be to look at your finalized 1040 form, as this is what was sent to the IRS. If your bank acct/routing numbers match, then the IRS has this info and will send to you via direct deposit. Most folks don't look at their 1040 after filing and just forget about them, but in this case... Download a copy of your tax return and check your acct. info. I've attached a copy for reference. If your bank matches lines 21b &21d, then you should be good, as this is what the IRS has. The SBTPG is done on the local level as far as intercepting returns to take fees (essentially, the front end), I believe, so there should be no issues regarding what info the IRS has. Hope this helps. Have a blessed Easter!

April 12, 2020

11:22 AM