- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

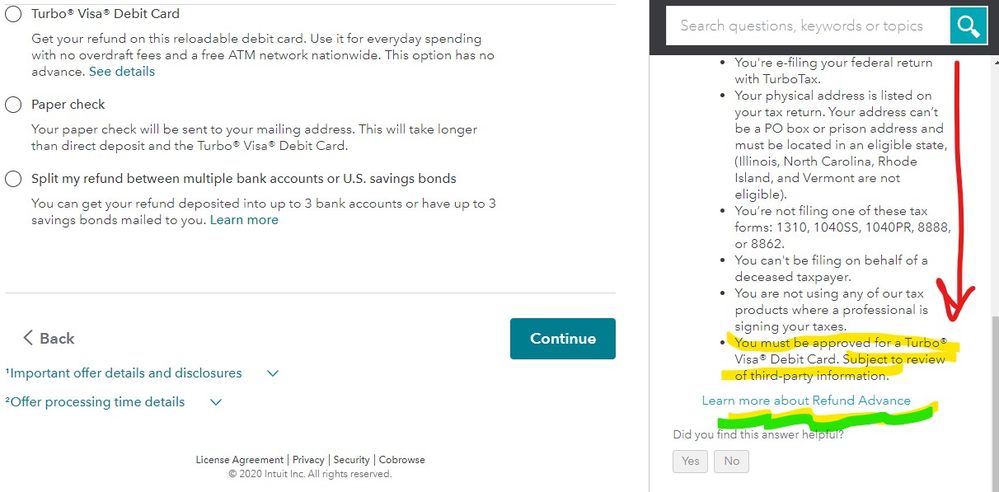

If greendot rejected the loan application before the IRS accepted the return then they had other issues with your situation... one place does say you must be approved by them ...

FYI .... all the banks that make these "refund anticipation" loans talk to each other ... did you already take out a loan with another tax prep company using the info on the 2019 return? Do you have issues with other banks like being behind on payments? Until you get the rejection letter you will not know for sure what happened.

February 4, 2020

4:12 PM