- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

Pennsylvania Form Rev-1630 is generated within the program based upon the information you have entered. It is for "Underpayment of Estimated Tax by Individuals".

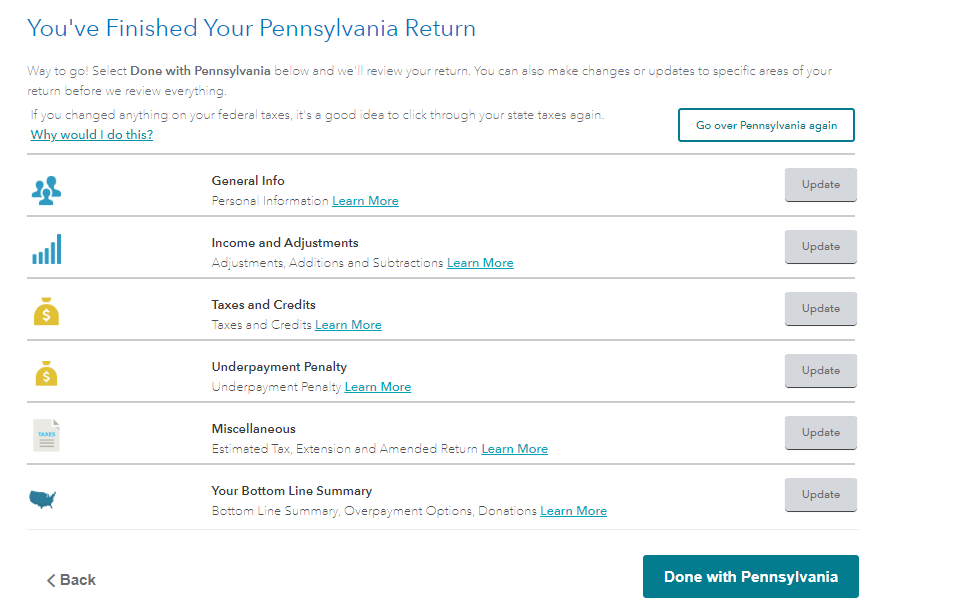

Once you have entered all of your information for Pennsylvania, you will see the following screen:

Select "Update" to the right of the Underpayment penalty to make any updates or adjustments to the calculation on PA Form Rev 1630.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 3, 2020

3:57 PM