- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

This thread started with @emilclu indicating, “I'm trying to import Vanguard tax data into my tax return.” I’m also trying to get that to work, and also trying to get similar data from Fidelity.

I’ve seen the references to Contact Support, which I have tried, but my effort there is no more effective than what we see in this thread.

I’ve seen the references to TurboTax Import Partners and found the 1099/1098 Partners List. Amongst many others, the list includes

- Vanguard Group - Brokerage Account

- Vanguard Group - Mutual Fund Accounts

- Fidelity Investments

@walter white was seems to have been able import from at least some account. In past years, it worked for me too.

In my case, my Vanguard Mutual Fund Accounts were changed to Vanguard Brokerage Accounts several years ago. I find the 1099-INT, 1099-DIV, 1099-B, etc., for the brokerage account has been easier to uses, at least in my past years of using TurboTax.

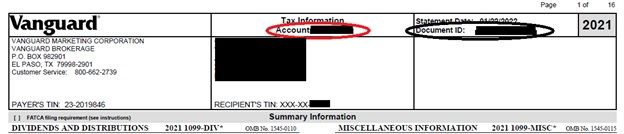

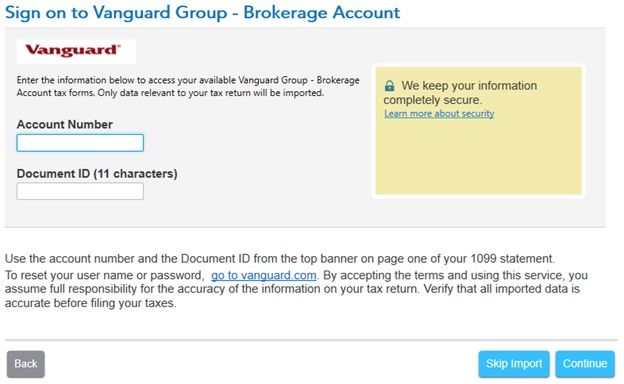

If one tries importing data from a Vanguard Brokerage Account, the Desktop TurboTax Premier 2021 application asks for Account Number and Document ID.

As @MyaD indicates, I can obtain the Account Number and Document ID from the top of a PDF version of the 1099 PDF file that I was able to download from Vanguard’s website to my desktop computer.

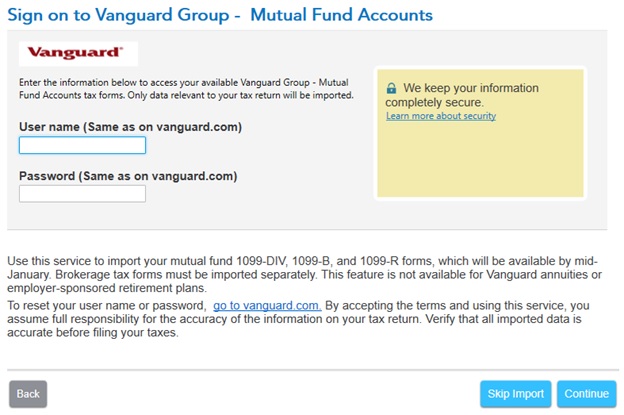

If one tries importing data from a Vanguard Mutual Fund Account, the Desktop TurboTax Premier 2021 application asks for a User name and Password.

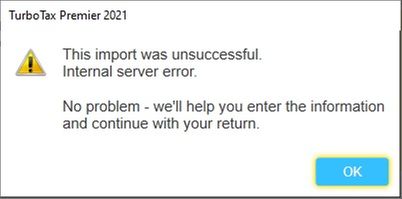

I was still unable to download tax data from Vanguard and Fidelity to TurboTax Premier 2021 installed on my desktop computer. I get this:

As the error dialog box indicates, this may indeed be a server side problem, I do not know. What does “Internal server error” suggests? If it is as indicated, trying this may work on another day.

When I try the online version of TurboTax, I can import the data from PDF versions of 1099 forms from Vanguard and Fidelity. I only had one 1099 that I could not import as PDF, and that is from TreasuryDirect, which seems a bit ironic.

K-1 forms for limited partnerships are another matter. In that case, the TurboTax on my desktop computer can import the K-1, but the online version cannot. For the online version, I hand entered the K-1 data, and that is more difficult than it seems. Furthermore, the software's Federal Review catches errors in what I entered, and finding the information needed to resolve the matter is not straightforward. I'm using the online version for now because it can import from Vanguard and Fidelity.

I might get as far as I can with the online version of the tax return, then transfer that file to my desktop. I could delete the K-1's, and then re-import them electronically. I think one or more of the K-1's will be revised soon so I will need to update those at that time.