- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Yes, your allocation is correct. Income and expenses should be allocated to each state based on your time in each state. Here is some general information about NY and S Corps. If a corporation is a federal S corporation and wishes to make the election for New York State, the corporation is required to file Form CT-6 and receive approval before filing Form CT-3-S or Form CT-34-SH, New York S Corporation Shareholders’ Information Schedule. Federal approval as an S corporation is not automatic approval for New York State.

Once a corporation has approval from the New York State Tax Department to be treated as a New York S corporation, it is required to file Form CT-3-S instead of Form CT-3, General Business Corporation §210.1(d) Franchise Tax Return. Form CT-3-S is used to pay the entity level franchise tax under Article 9-A. Such tax is the fixed dollar minimum tax imposed under §210.1(d).

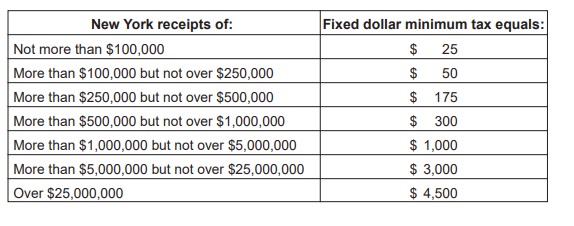

Fixed dollar minimum tax for all New York S corporations (except qualified New York manufacturers or qualified emerging technology companies (QETCs)) Fixed dollar minimum tax equals:

You can use the above chart to determine whether your NY tax for the S Corp is correct based on the indicated receipt amounts. The above chart and NY S Corp information was obtained from the NY tax website and can be found using the below link.

Instructions for NY S Corp Franchise Tax Return

**Mark the post that answers your question by clicking on "Mark as Best Answer"