- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

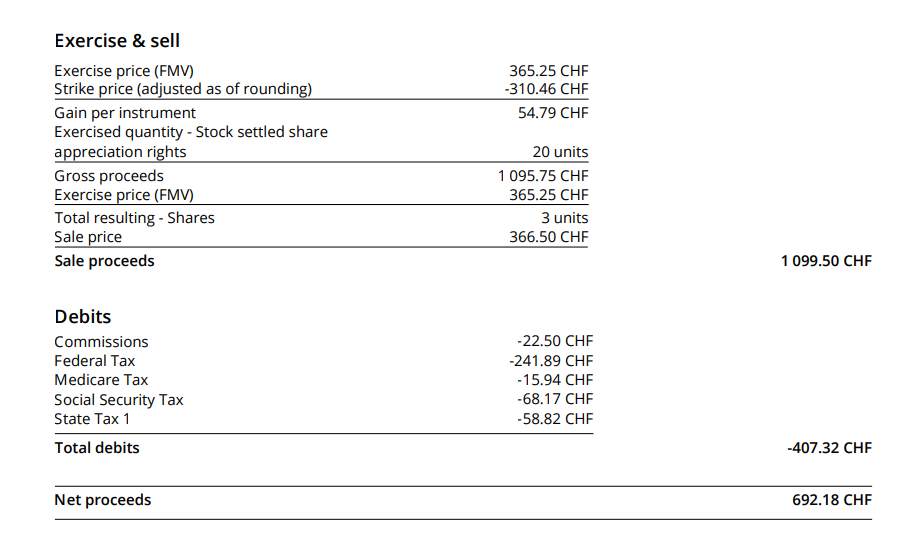

Thanks, @ThomasM125 . I have a SAR value on my W-2 in Box 14, but nothing in the Box 1 breakdown, so am I to assume the value in Box 14 was included in my gross pay for Box 1? (It seems like it was, based on the number). To me, that makes me think the SAR income has already been factored in as ordinary income and taxed (as the transaction statement from the broker shows.) I suppose I can still follow your instructions and calculate a cost basis by calculating what the total value of the award was when it was issued, versus what it appreciated to when I sold. But, I still think I am paying taxes twice on those gains, since the sale was fully taxed by the broker at the time of sale, not vest.

Here's an example of the broker's transaction statement for one of the sales, it looks fully taxed at the time of sale: