- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital gains tax

Hello,

my husband and I bought our first home in March of 2020. He got a new job and we are in the process of selling our home to relocate three hours away.

Being that we only lived here for 1.5 years I know we will have capital gains, but we are trying to research our exemption options.

How do we file exemptions for relocating for employment, and how much deduction is that for the total amount?

Are there any rules where we have to buy our next home in a certain amount of time to not pay the capital gains?

thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

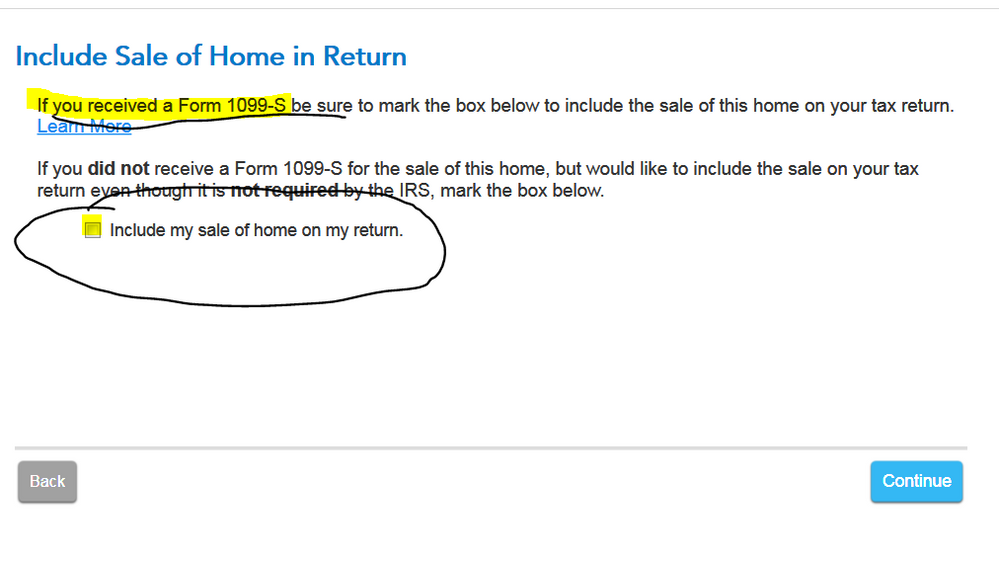

A partial exclusion for change in employment is handled in the home sale section of the interview so just follow the interview screens carefully. Most important is that you indicate you got a 1099-S at the closing and click on that box ...

To report the sale of a primary personal residence -

- Click on Federal Taxes (Personal using Home and Business)

- Click on Wages and Income (Personal Income using Home and Business)

- Click on I'll choose what I work on (if shown)

- Scroll down to Less Common Income

- On Sale of Home (gain or loss), click the start or update button

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Rollover of your capital gain into your new home - that option was taken out of the Tax Code a long time ago.

How much profit do you have after 18 months?

Don't forget to adjust for closing costs.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

For work-related moves see https://www.irs.gov/publications/p523#en_US_2020_publink100073097