- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Thanks so much for taking the time to share this! I appreciate it. I somewhat kept up with you 😀

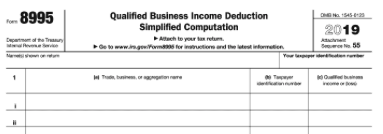

My concern wasn't with the QBI deduction, but rather the QBI itself, or the income being reported on the top of form 8898 (e.g. the first row). shouldn't the number here be the same as the business profit reported on schedule C? I realize that you're the expert, but I'm just worried that something is wrong. For example, if my profit on Schedule C is $150 (to put it simply), It's putting that number as 105 (this is a made up number but the QBI income is like 93% of whatever is on schedule C). I do realize that later on the 8895 they use these numbers to get the deduction number. Does that make sense?

Maybe it's all in my head and likely due to not having a deep enough understanding of how it all works, and I'll just accept that it's correct.