- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

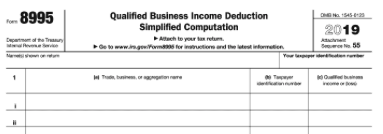

QBI on form 8895 different than on Schedule C

Why is my Qualified Business Income on schedule C (line 31) different on form 8895? Are these numbers supposed to match? I deleted and re-entered the business expense but it still appears that way. It seems like a software error

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

No, they are not necessarily supposed to match. Look at the QBI Component form from your return. It shows how the QBI was calculated for your business.

With the QBI deduction, most self-employed taxpayers and small business owners can exclude up to 20% of their qualified business income from federal income tax (but not self-employment tax) whether they itemize or not.

The deduction amount depends on the taxpayer's total taxable income, which includes wages, interest, capital gains (etc.) in addition to income generated by the business. Once the taxable income reaches or exceeds $163,300 ($326,600 if filing jointly), the type of business also comes into play.

At incomes below that level, the deduction is 20% of either taxable income (minus capital gains and dividends) or the QBI, whichever is less.

At higher income levels, the deduction is reduced or eliminated, depending on the nature of the business. The calculations also get quite complicated, but TurboTax easily handles them and will figure out how much of a deduction you’re entitled to.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Thanks. My concern was that the income on form 8895 (c) looks transposed.

How is the number on form 8895 i (c) calculated?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Warning - it is complicated, even for tax peoples! I put the calculation below but it is in the link above if you need or want to refer to it later...

The deduction depends on the taxpayer’s total taxable income, which includes wages, interest, capital gains, etc. in addition to QBI. At higher income levels, whether or not the business is an SSTB will also play a role.

Under $163,300 ($326,600 if filing jointly): The calculation is straightforward — 20% is applied to QBI or taxable income minus capital gains and dividends (whichever is less) to come up with the deduction. It doesn’t matter if the business is an SSTB; the QBI deduction comes out the same.

For instance, a taxpayer with $30,000 of QBI, $100,000 in total taxable income, and $5,000 in capital gains would simply apply 20% to their QBI because it’s the lesser of the two amounts ($30,000 vs. $95,000). In this case, they’d get 20% of $30,000 for a $6,000 deduction.

$163,300 to $213,300 ($326,600 to $426,600 if filing jointly): Here’s where things get complicated. Let’s start with a fictitious example so you can follow along.

Jack and Jill are joint filers, and here’s the info they’ll need to calculate their QBI deduction:

- Total taxable income = $400,000

- QBI = $300,000 (and 20% of QBI = $60,000)

- W-2 wages paid = $50,000

- Unadjusted basis of qualified property = $800,000

- Their restaurant business is not classified as an SSTB

First, they calculate their reduction ratio (this is just a variable needed in the final calculation):

- Formula for joint filers = (Taxable income – $326,600) ÷ $100,000

- Formula for all others = (Taxable income – $163,300) ÷ $50,000

Because they are filing jointly, Jack and Jill’s reduction ratio = ($400,000 – $326,600) ÷ $100,000 = 0.734.

Next, they calculate their excess amount, which is another number they'll need for the final calculation. It starts with the greater of these 2 amounts:

- 50% of W-2 wages paid, or

- 25% of W-2 wages paid plus 2.5% of the unadjusted basis of qualified property.

For Jack and Jill, these 2 amounts work out to $25,000 and $32,500 respectively, with the $32,500 being the greater amount. To calculate their excess amount, they subtract the greater amount figure of $32,500 from 20% of their QBI ($60,000) to come up with $27,500.

Now, all they need to do is plug these numbers into final QBI deduction formula:

20% of QBI – (reduction ratio × excess amount) = QBI deduction

The QBI deduction for Jack and Jill’s restaurant business works out to:

$60,000 – (0.734 × $27,500) = $39,815

If Jack and Jill's business was classified an SSTB, for example a CPA firm or veterinarian practice, they would simply apply a special factor (1 minus their reduction ratio) to the previous result to calculate their QBI deduction:

$39,815 x (1 – 0.734) = $10,591

Phew! That was a ton of math, but if you happen to fall into this income bracket, rest assured that TurboTax handles this calculation with ease and in a lot less time than we took to explain it here.

Over $213,300 (over $426,600 if filing jointly)

SSTBs don’t qualify for the deduction, period.

For non-SSTBs, the deduction is either A or B, whichever is less:

- A = 50% of the business's W-2 wages paid (or 25% of the W-2 wages paid plus 2.5% of the business's unadjusted basis in all qualified property), whichever one is the greater amount

- B = 20% of QBI

If we borrow the numbers from Jack and Jill’s restaurant business (for illustration purposes only), their deduction would be the lesser of:

- A = $25,000 or $32,500 (whichever figure is greater, in this case $32,500), or

- B = $60,000.

Because A ($32,500) is less than B ($60,000), they get a $32,500 deduction.

If all of this sounds complicated, it is, at least when you get to the higher income levels. But the good news is TurboTax will take care of the calculations and let you know if you qualified and how much of a deduction you’re entitled to.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Thanks so much for taking the time to share this! I appreciate it. I somewhat kept up with you 😀

My concern wasn't with the QBI deduction, but rather the QBI itself, or the income being reported on the top of form 8898 (e.g. the first row). shouldn't the number here be the same as the business profit reported on schedule C? I realize that you're the expert, but I'm just worried that something is wrong. For example, if my profit on Schedule C is $150 (to put it simply), It's putting that number as 105 (this is a made up number but the QBI income is like 93% of whatever is on schedule C). I do realize that later on the 8895 they use these numbers to get the deduction number. Does that make sense?

Maybe it's all in my head and likely due to not having a deep enough understanding of how it all works, and I'll just accept that it's correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

There are adjustments made to your Schedule C income to derive at the Qualified Business income number. To see how the QBI (not the deduction) is calculated, look at your Schedule C. About halfway down, you will see the QBID Worksheet. It shows you how it is calculated. Your QBI is on Line 10. The adjustments are summarized in the example below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

This was EXTREMELY helpful! thank you sooo much!