- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Underpayment penalty for large uneven capital gains

I had a few months in 2020 where I sold a large amount of stock for long term capital gains. Couple of questions:

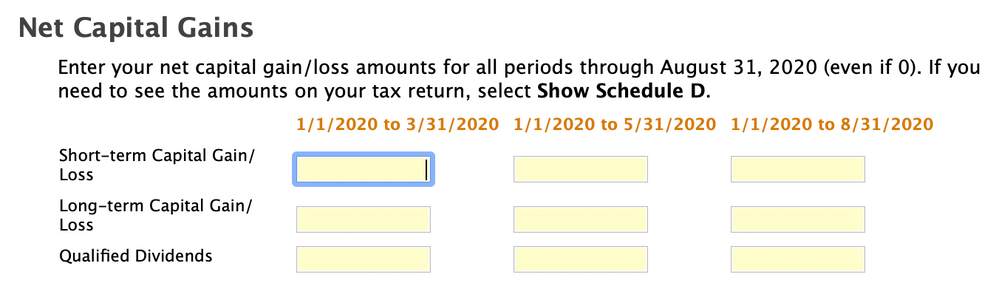

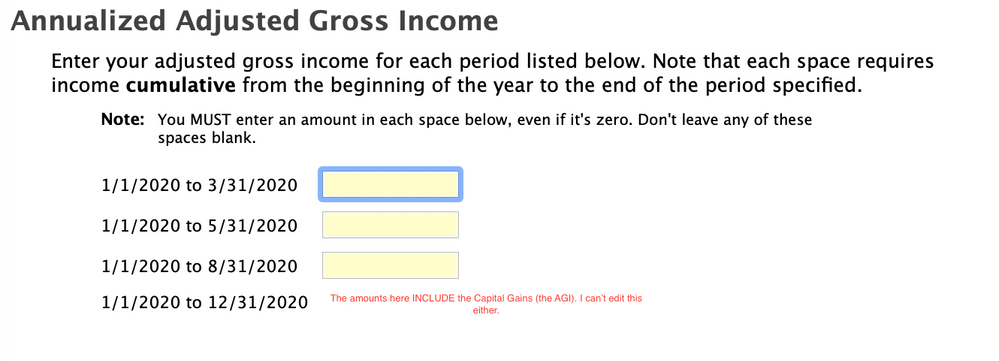

- Tried to Annualized Income Method but it's a bit confusing. My capital gains are included in the AGI. In TT, there are two interview questions a) Asks my total AGI (which includes the capital gains) over the last year b) Then it asks again what my capital gains were over the year. Is it double counting - since the gains were already in the AGI?

- Penalty seems to be almost around $400. Should I pay this amount and let IRS calculate the penalty for me so there are no mistakes?

Thanks!

See photos

April 13, 2021

10:13 PM