- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

No, you cannot deduct the amount of your W-2. Please enter your W-2 as shown.

Since they will not send a corrected W-2, you could use a "claim of right" Section 1341 credit. This is a federal tax credit for taxpayers who reported income in the previous year, but have to repay the income because it was paid in error. The Section 1341 credit is found on your 1040, Schedule 3. I have included instructions below on entering this in TurboTax.

For the method on how to calculate your amounts for your "claim of right", please see Publication 525 and go to page 35. Please keep in mind that these Section 1341 credits do tend to get questioned by the IRS, so it is important to keep all of your documentation in order.

To enter, please follow the instructions below:

- Open your return.

- Click on Federal.

- Click on Deductions and Credits.

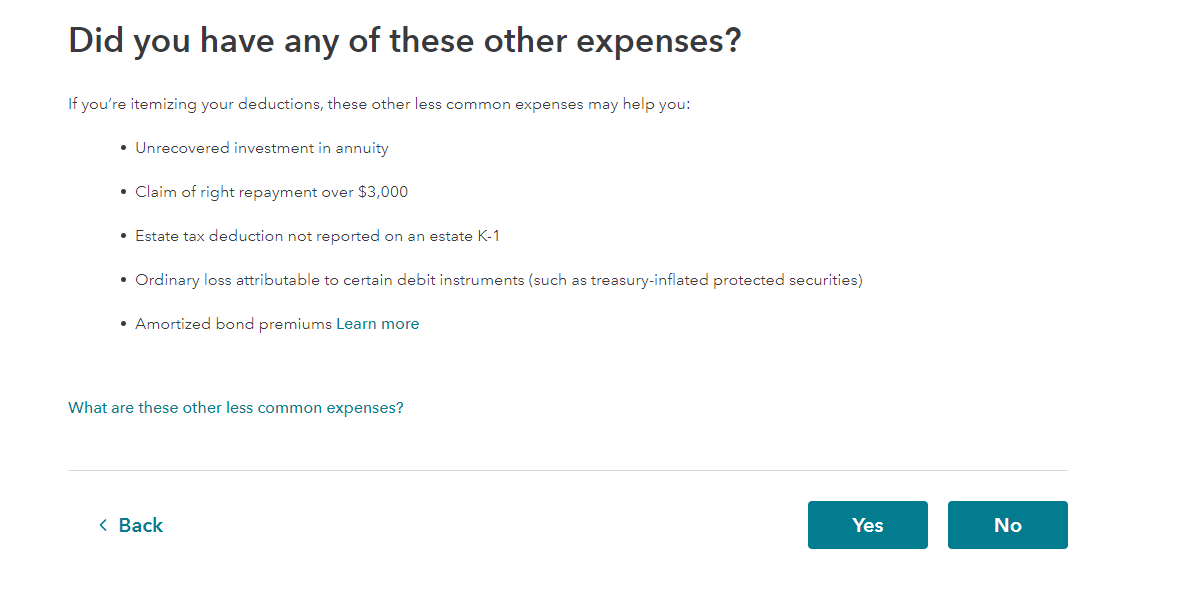

- Scroll down to Other Deductions and Credits and Click Start next to Other Deductible Expenses.

- Answer Yes to the question Did you have any of these other expenses?

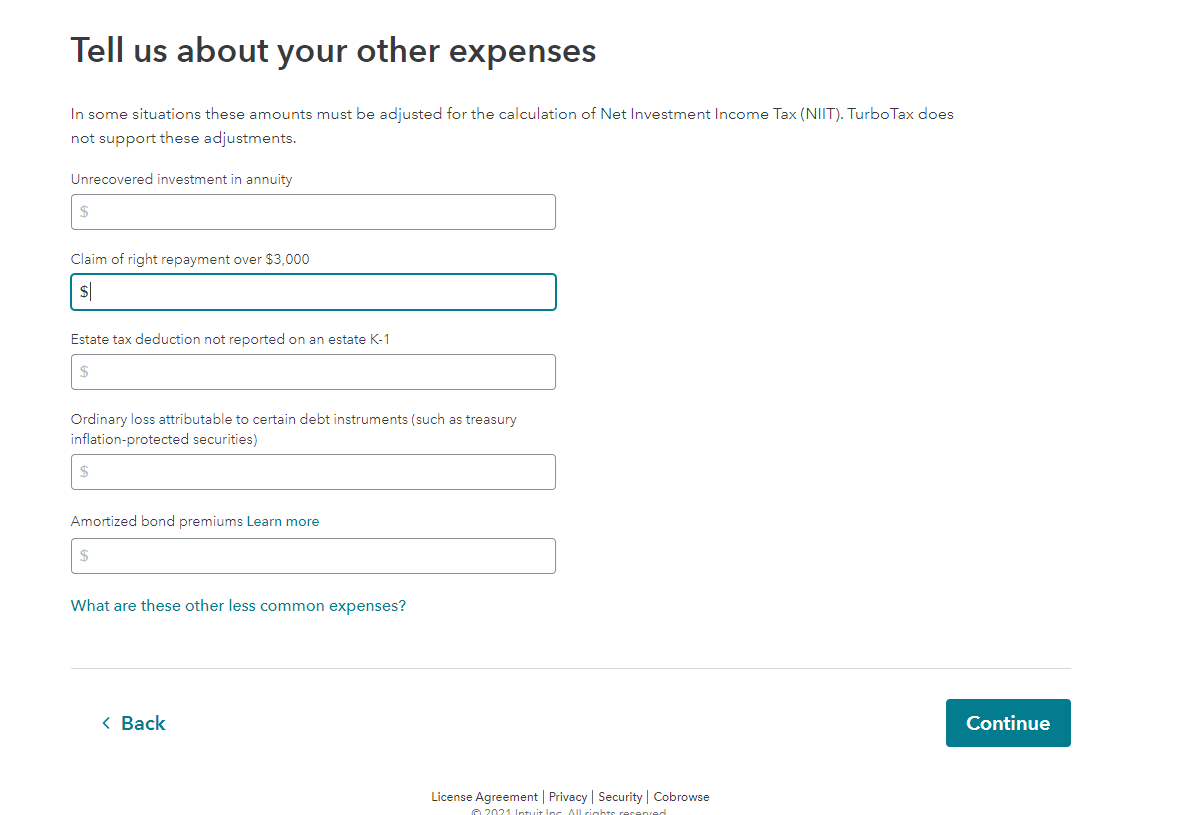

- Enter the amount in Claim of repayment over $3,000.

I have attached screenshots below for additional guidance.

**Mark the post that answers your question by clicking on "Mark as Best Answer"