- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Hi @DaveF1006 . Many thanks for your detailed answer. I am indeed

- A U.S. citizen or a U.S. resident alien who is physically present in a foreign country or countries for at least 330 full days during any period of 12 consecutive months.

I followed your steps

1) Reported the income from the 1099-NEC in the self-employment section

2) Went all the way through the Foreign Earning Exclusion. Got to this final screen.

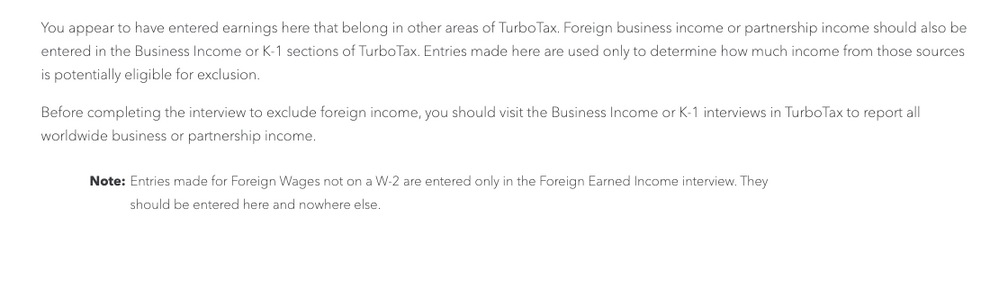

To clarify, I only have 2 income sources W2, and 1099-NEC. I declared both and declared W2 as foreign income. From the error message it looks like I should not declare the1099-NEC in the self-reported income section ("They should be entered here and nowhere else"). Thoughts?

February 22, 2021

3:54 PM