- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

This is normally caused by a browser issue.

Use the Chrome browser, not the app

Click the three dots in the upper right corner

Select Settings

Privacy and Security

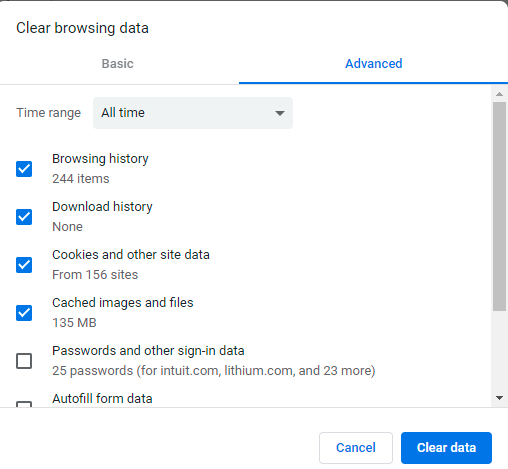

Clear browser data for all time

Then sign in to TurboTax on the Chrome browser

Go to Tax Tools, Tools, Delete a Form and delete the 1098-T for the school and the Education and Fees Summary

Go to the program and delete any of your information for 1098-T that is still there

Then enter the 1098-T information again.

Computers will hold old data and overwrite the current data.

Schools must send Form 1098-T to any student who paid "qualified educational expenses" in the preceding tax year. Qualified expenses include:

- tuition,

- any fees that are required for enrollment,

- and course materials required for a student to be enrolled.

If someone else pays such expenses on behalf of the student (like a parent), the student still gets "credit" for them and receives the 1098-T. Schools must send the form to the student by January 31 and file a copy with the IRS by February 28.