- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

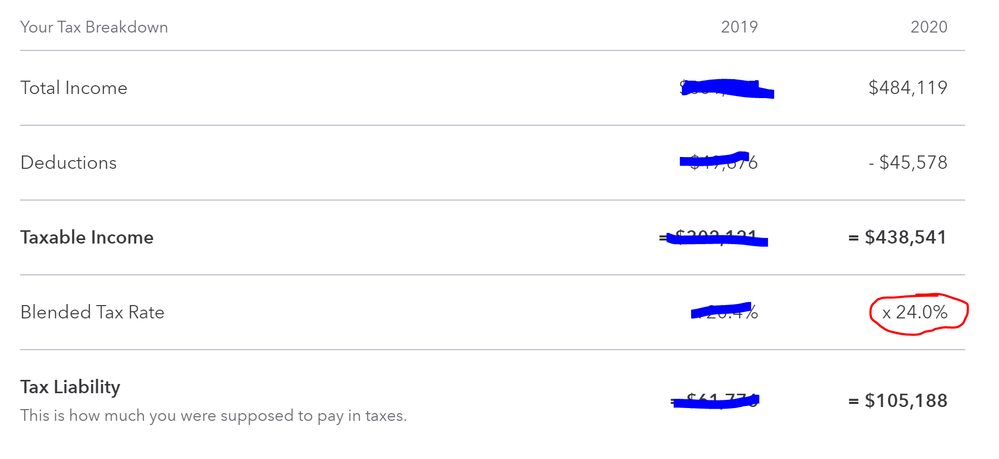

Federal Tax Liability Calculation Incorrect

Can anyone explain why TurboTax is calculating the blended tax rate incorrectly (married filing jointly)? It calculates here as 24% based on the taxable income but it should be closer to 23.5%. That difference amounts to almost 2,000 more taxes that TurboTax says that I owe that I don't. I suspect there is a rounding error here, but even then, if you multiply 24% times the taxable income the number is different from the tax liability listed which tells me they aren't rounding (only to show the above for ease of display). Either way it is somehow wrong. I've entered everything so far except my 1099-B, so perhaps that changes it? Either way it's weird that it would display those numbers so simply, and incorrectly.

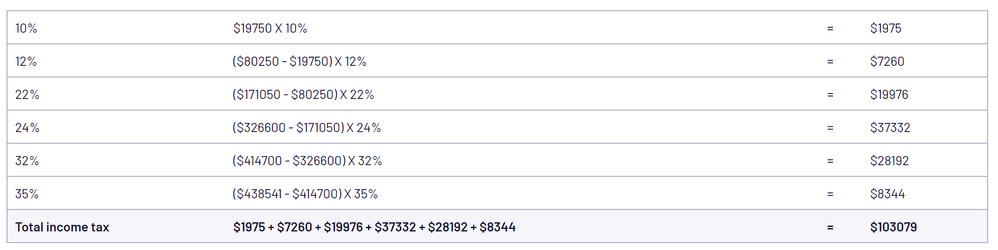

Here is how the calculation should be done.

After this and the absolute travesty that is the mortgage interest deduction worksheet / quiz, I might have to find an alternative to TT.