- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

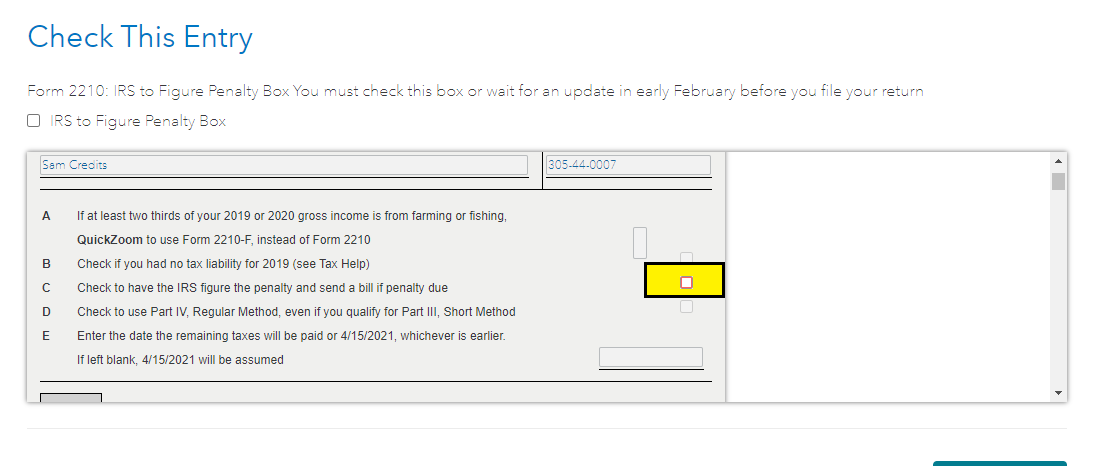

To clarify, the amount of tax owed does not have a penalty if the total tax shown on your 2020 return minus the amount of tax you paid through withholding is less than $1,000. This does not include any estimated tax payments you might have made. If the amount owed is because of estimated tax underpayments, the $1,000 rule does not apply. If you find that this does apply to your, then you should check the box for IRS to calculate the penalty and complete your return.

Due to the dates changes and exceptions allowed for COVID-19, you can choose to check the box to let the IRS calculate your penalty instead of adding it to your tax return. (see images below)

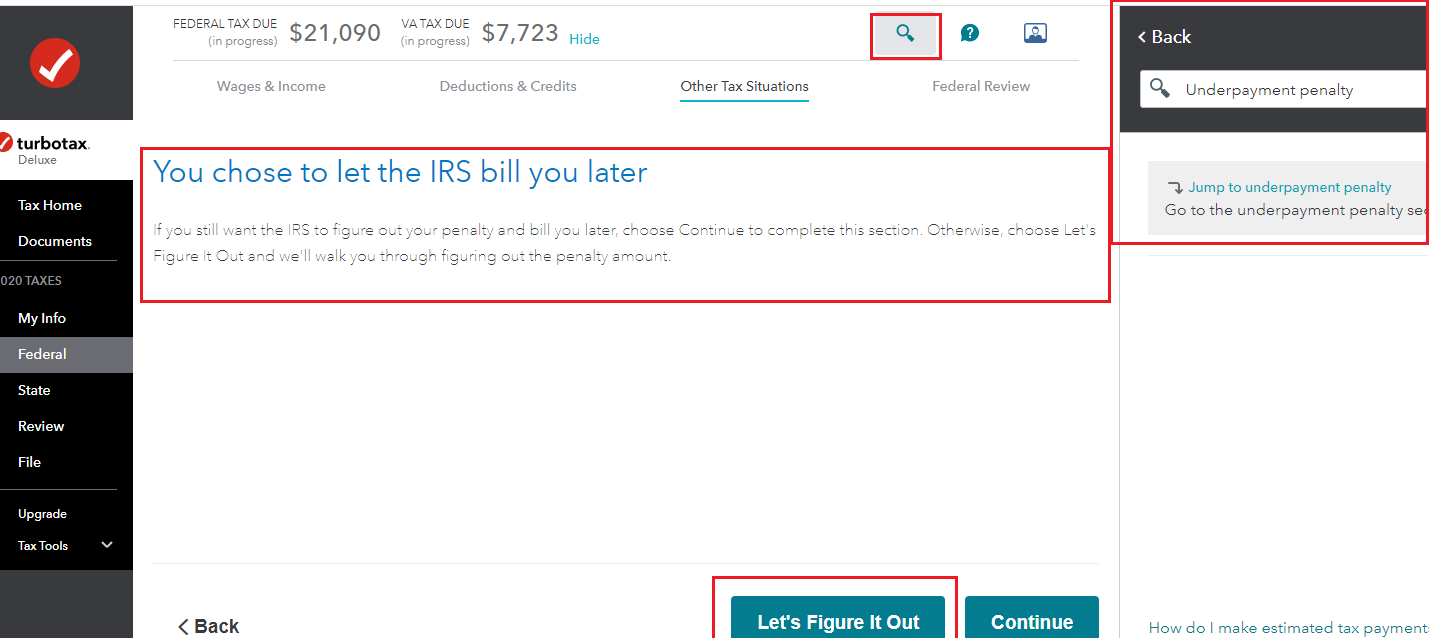

If you choose that and then change your mind you can go back to adding the Form 2210 calculations by using the following steps.

- With your TurboTax account open search (upper right) for underpayment penalty > Enter > select the Jump to link in the search results.

- Follow the prompts to change your original entry ( this will allow you to choose Let's Figure it Out

**Mark the post that answers your question by clicking on "Mark as Best Answer"