- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

Yes. In the federal interview, you must enter the correct taxable amount on the Form W-2.

Yes, the remaining investment will change. The financial institution will provide the expected return each year and it will change based on age and remaining balance, as well as rates which also fluctuate.

If you would recover the entire contribution balance in three years of course you could use that method. Then everything received after that would be fully taxable.

Once you have determined the amount that should be taxable on the New Jersey return, you must go back to the federal entry of the Form W-2 and enter the taxable amount in the State Distribution field. Be sure to enter any state withholding and you can use the federal EIN if there is not a State Number listed for Box 15.

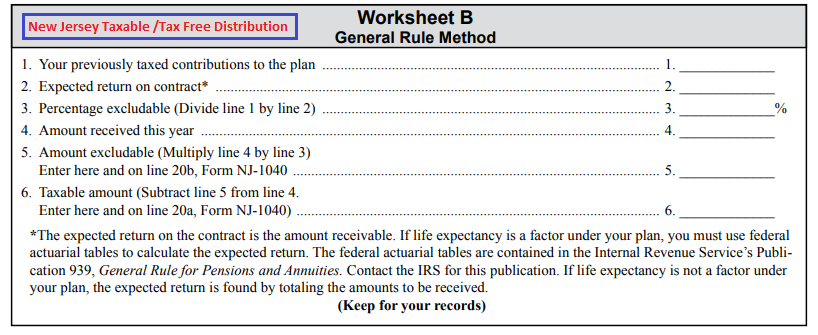

Use the worksheet you have pictured to determine the taxable/tax-free amount each year for your entry. You are on track.

- New Jersey 1040 Instructions

- See the image below

**Mark the post that answers your question by clicking on "Mark as Best Answer"