- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax calculation of 2019 Schedule E QBI is opaque and may not be correct

I have done my own taxes with TurboTax for years, learning the relevant tax sections as needed to confirm the results presented in TurboTax. But this is the first time I have not been able to reconcile the calculations in TurboTax with the tax code.

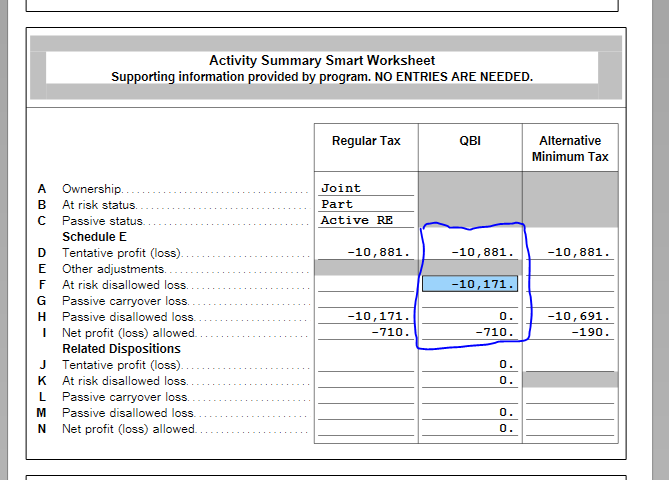

I have 12 Single-Family and Multi-Family properties and TurboTax does not handle QBI in a consistent manner across properties. Furthermore, the Activity Summary Smart Worksheet, which is the key to understanding the flow of the QBI amounts, does not list the Data Source for any numbers in the QBI column (circled below). I have called TurboTax Support twice, spoke to Enrolled agents, provided detailed descriptions about my concerns, and provided debug copies of my return. Each time, my case has been closed without explanation. Below is a screenshot of one of the worksheets from the Schedule E of one of my properties. What are the data sources for each of the rows circled in the QBI column?

BTW, this property did not have any At-Risk Disallowed Loss for 2018 or 2019 so why does line F, QBI, contain -$10,171? That should be a Passive Activity Disallowed Loss. Reclassifying a loss from section 465(d) to section 469 is not compliant according to section 1.199A-3(b)(1)(iv)(C).